[ad_1]

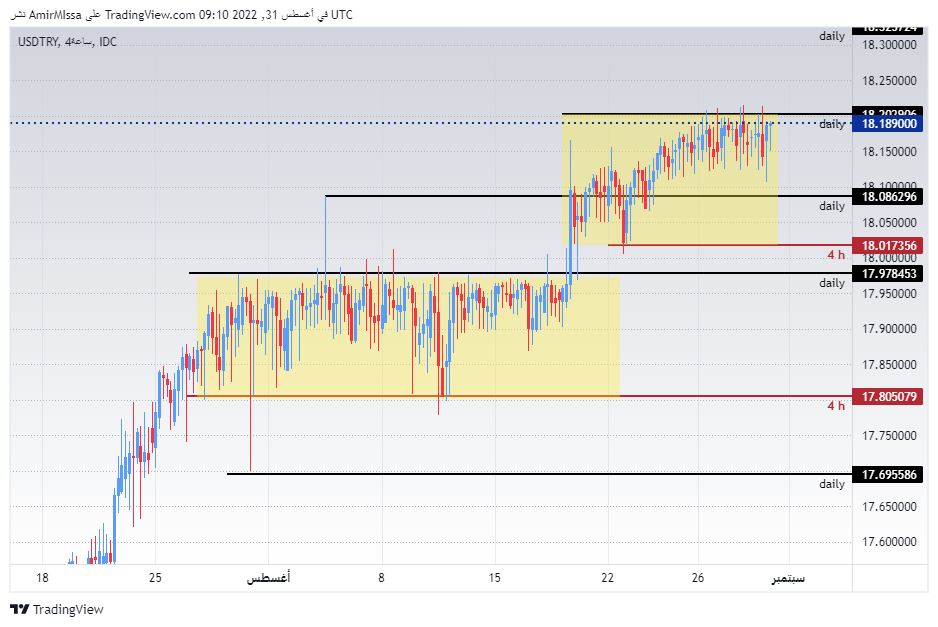

The USD/TRY is trading within a narrow trading range, which is shown on the chart, near its highest levels during 2022.

Today’s recommendation on the USD/TRY

- Risk 0.50%.

- None of yesterday’s buy or sell transactions were activated

Best selling entry points

- Entering a short position with a pending order from levels of 18.33

- Set a stop-loss point to close the lowest support levels at 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 17.70.

Best buying entry points

- Entering a long position with a pending order from levels of 18.10

- The best points for setting stop-loss are closing the highest levels of 17.94.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the support levels 18.31.

USD/TRY Technical Analysis

The Turkish lira has stabilized against the dollar at the same levels it is trading at during the current month. Where the lira was not affected much by any positive or negative data, as the exchange rate did not decline against the dollar after cutting interest earlier this month.

Neither did it rise after positive data this morning regarding the gross domestic product, which shows the continued intervention of the Turkish Central in the exchange rate by imposing certain limits.

In the details of the data, the country’s gross domestic product recorded a growth of 2.1 percent to reach $219 billion, according to the country’s Statistics Institute this morning. The economy recorded a growth of 7.6% during the second quarter of this year, on an annual basis. The data also revealed an increase in household expenditures during the second quarter of this year by about 22 percent, and exports of goods increased by 16 percent.

On the technical front, there was no change. The USD/TRY is trading within a narrow trading range, which is shown on the chart, near its highest levels during 2022. The pair is also trading above the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on The 60-minute time frame is indicating a long-term bullish trend.

The pair also traded the highest support levels, which are concentrated at 18.08 and 17.98, respectively. While it is trading below the resistance levels at 18.20 and 18.33, which are the highest levels of the pair recorded at the end of last year, respectively. The chance of the lira rising against the dollar is still slim as the pair is heading in an overall bullish trend. As each decline represents a good opportunity to buy, please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free trading signals? We’ve made a list of the best brokers to trade Forex worth using.

[ad_2]