[ad_1]

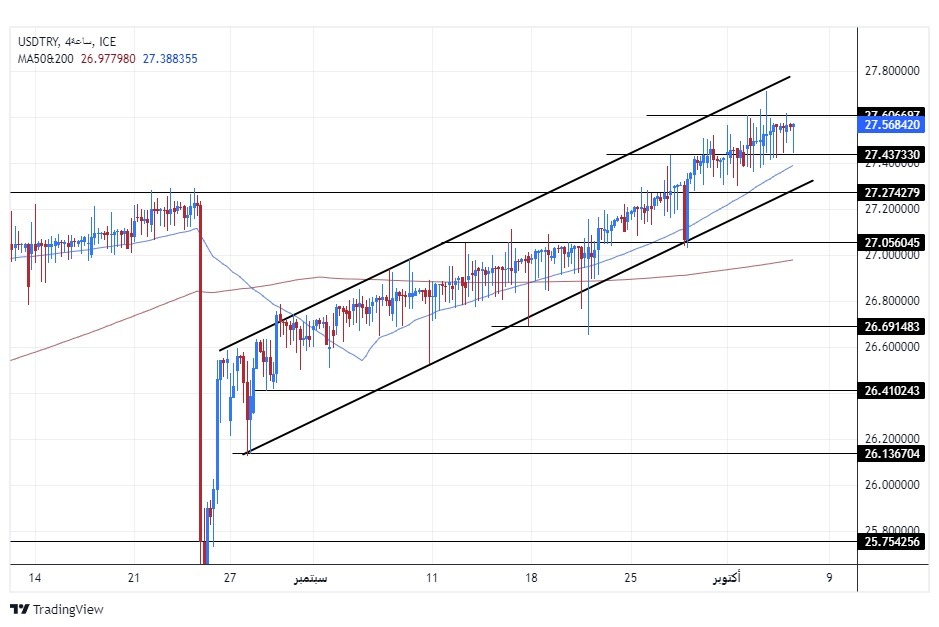

On the technical level, the dollar pair against the Turkish lira recorded a discrepancy near its highest level ever.

Forex Brokers We Recommend in Your Region

See full brokers list

Risk 0.50%.

- Entering a buy deal with a pending order from the 27.00 level.

- Place a stop loss closing point below the 26.75 level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 27.70.

- Entering a sell deal with a pending order from the 27.75 level.

- The best points to place a stop loss are closing the highest level of 27.85.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 26.90.

The price of the Turkish Lira varied against the US dollar during early trading on Thursday morning, with the pair recording its highest levels ever. Data revealed that the country’s trade deficit recorded a significant decline during last September, as a result of a significant increase in the volume of Turkish exports by 0.3% in conjunction with a decline in the volume of imports by 14.1%, as imports recorded a decline for the third month in a row. The economic slowdown contributed to pressure on imports. The lira, which supported exports and turned imports into expensive goods, also declined. At the same time, the gap in the volume of foreign trade declined to about $5 billion, down from levels of $9.6 billion in the same period of the previous year. Reports revealed an improvement in the volume of Turkish exports, despite the slowdown in European markets, which represent the first market for European exports.

Successive interest rate increases by the Turkish Central Bank over the past months have contributed to limiting credit, amid the new economic team’s efforts to quickly shift monetary policy to tighten to control inflation rates that expanded significantly in the period following the presidential elections that took place in June. the past. The latest statements issued by the Governor of the Turkish Central Bank, Hafiza Ghaya Arkan, expected inflation to decline starting from the middle of next year.

On the technical level, the dollar pair against the Turkish lira recorded a discrepancy near its highest level ever, as the pair is trading at the upper border of the ascending price channel on the 240-minute time frame shown in the chart.

Currently, if the pair goes up, it targets the resistance levels concentrated at 27.75 and 27.99, respectively, while if the pair declines, it targets the support levels concentrated at 27.30 and 26.99, respectively. The price is moving above the 50 and 200 moving averages on the daily time frame, as well as on the four-hour and 60-minute time frames, indicating the buyers’ control and the return of the general upward trend recorded by the pair. The pair is expected to record gains as long as it settles within the ascending price channel range. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

[ad_2]