[ad_1]

Currently, if the pair goes up, it targets the resistance levels concentrated at 27.75 and 27.99, respectively, while if the pair declines, it targets the support levels concentrated at 27.30 and 26.99, respectively.

Forex Brokers We Recommend in Your Region

See full brokers list

Risk 0.50%.

- Entering a buy deal with a pending order from the 27.00 level.

- Place a stop loss closing point below the 26.75 level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 27.70.

- Entering a sell deal with a pending order from the 27.75 level.

- The best points to place a stop loss are closing the highest level of 27.85.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 26.90.

The price of the Turkish Lira declined against the US dollar during early trading on Tuesday morning, as the Turkish currency stabilized near its lowest levels ever against the dollar. Investors followed the Turkish data that was issued early this morning, which revealed the expansion of inflation in the country during the month of last September, as the consumer price index rose on an annual basis to reach 61.53%, compared to the 58.94% recorded in August, although it was less than expectations that were expected. At 61.70%. While inflation declined on a monthly basis to reach 4.75% during September, which is a lower rate than expectations, which were centered at 4.88%, the rate was also lower than the inflation recorded in August at 9.9%.

The data shows that inflation continues to expand in the country despite the major shift in monetary policy over the past four months, as the economic team tightened monetary policy and raised interest rates from 8.5% since last June to 30% during the last meetings of the Turkish Central Bank during the month. Last September. Reports attributed the increase in inflation in the country as a response to the stimulus policy followed by the Turkish President prior to the last presidential elections, as well as the large government spending that took place in the same period.

It is noteworthy that the statements of Turkish Finance Minister Mehmet Simsek issued at the beginning of this week indicate that despite the shift in monetary policy, the results need more time.

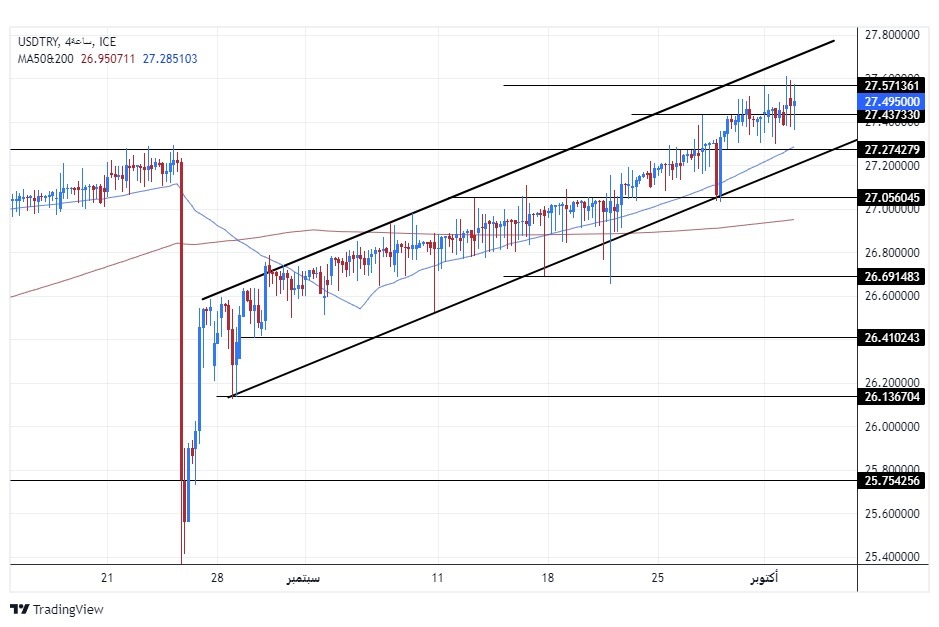

On the technical level, the dollar pair against the Turkish lira has stabilized near its highest level ever, as the pair is currently trading at the upper border of the ascending price channel on the 240-minute time frame shown in the chart.

Currently, if the pair goes up, it targets the resistance levels concentrated at 27.75 and 27.99, respectively, while if the pair declines, it targets the support levels concentrated at 27.30 and 26.99, respectively.

The price is moving above the 50 and 200 moving averages on the daily time frame, as well as on the four-hour and 60-minute time frames, indicating the buyers’ control and the return of the general upward trend recorded by the pair. The pair is expected to record gains as long as it settles within the ascending price channel range. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.

[ad_2]