[ad_1]

The move by the U.S. Federal Reserve to hold the line regarding its interest rate yesterday, but in the same breath say it will likely raise the Federal Funds Rate in the near future did not come as a surprise to the global Forex market in many cases.

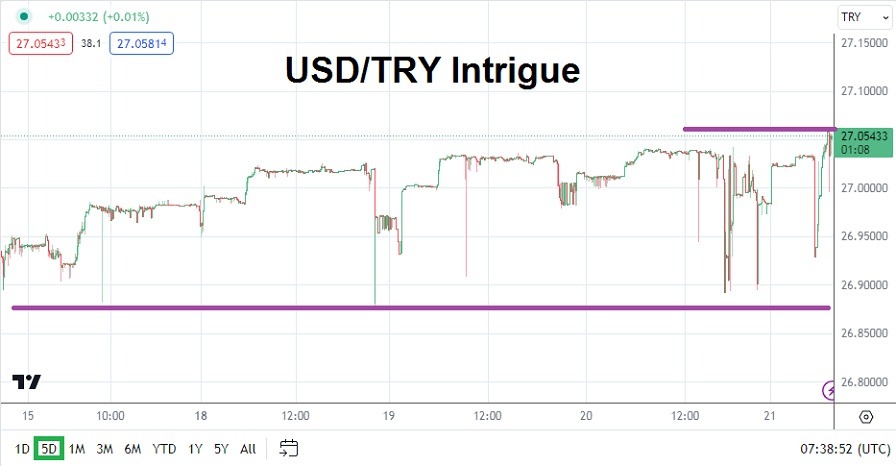

The USD/TRY is trading near 27.02700 as of this writing with price changes being displayed in solid manner in early action. The USD/TRY moved above the 27.00000 level on Monday of this week, and while it’s trading has produced an incremental climb higher which can be called rather polite, it is the downside price action that may grab the attention of speculators who are participating in the USD/TRY as a wagering tool. The USD/TRY is producing a healthy dose of downside ability suddenly on a daily basis.

Forex Brokers We Recommend in Your Region

See full brokers list

The move by the U.S. Federal Reserve to hold the line regarding its interest rate yesterday, but in the same breath say it will likely raise the Federal Funds Rate in the near future did not come as a surprise to the global Forex market in many cases. The USD/TRY acted in a correlated manner to the broad markets and this morning’s highs in the Forex currency pair mirror the strength the USD is expressing against most major currencies it is paired against.

The rather steady and slow move higher by the USD/TRY the past week and month has in fact demonstrated a rather refreshing healthy trading environment. Yes, the move higher has been a perceptible trend upward, but its progression has not been violent.

However, what should intrigue USD/TRY traders are the rather steep selloffs sometimes produced in the currency pair technically after a high has been produced. Timing the selloffs will be extremely difficult for day traders, but a glance at a one-week and one-month chart shows the rather sharp selloffs that sometimes occur.

The question for experienced traders of the USD/TRY is if they are talented enough with their technical interpretations to visualize and decide a solid selloff has taken place and support has been hit, or the opposite has happened and resistance higher will suddenly develop a strong reversal lower?

- Entering a buying position after a selloff to wager on potential upside price action developing needs solid entry price orders, then effective take profit and stop loss orders too.

- The same can be said for wanting to sell the USD/TRY and looking for a selloff after resistance has been touched and a reversal lower is sought.

- The price range of the USD/TRY has substantially tightened in the past few months, so small moves are likely being wagered on.

- Meaning to achieve the bigger outcome for positions, increased leverage is likely being used, but this is dangerous and the amount of leverage should be conservative.

Current Resistance: 27.05400

Current Support: 27.00000

High Target: 27.05900

Low Target: 26.87800

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.

[ad_2]