[ad_1]

Currently, if the pair goes up, it targets the resistance levels concentrated at 27.27 and 27.50, respectively, while if the pair declines, it targets the support levels concentrated at 26.50 and 26.13, respectively.

Forex Brokers We Recommend in Your Region

See full brokers list

Risk 0.50%.

- Entering a buy deal with a pending order from the 26.65 level.

- Place a stop loss closing point below the 26.15 level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 27.20.

- Entering a sell deal with a pending order from the 27.30 level.

- The best points to place a stop loss are closing the highest level of 27.65.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 26.70.

The USD/TRY stabilized, recording slight movements during European trading on Wednesday. Investors followed the statements of Turkish Finance Minister Mehmet Simsek. He said that his country had succeeded in obtaining external financing estimated at approximately 10.4 billion dollars since last June, financing that included Industry, banking, and non-banking finance sectors, in conjunction with the changes adopted by the Turkish countries in monetary policy. The Turkish Central Bank tightened monetary policy to combat high inflation, which expanded the impact of the stimulus policy that was followed in the period before the elections.

It is noteworthy that the Turkish Central Bank has approved a number of measures with the aim of restricting demand, reducing the current account deficit, and withdrawing liquidity from the markets as part of the bank’s plans to curb inflation, which has returned to its rise during the last two months at a significant pace. The Turkish Central Bank also raised interest rates from levels of 8.5 percent at the beginning of last June, to levels of 25 percent at the present time. In this regard, investors are awaiting the Turkish interest rate decision tomorrow, Thursday, as expectations vary between raising it to levels of 30 percent or less. While most expectations indicate that the Central Bank will raise interest rates to 35 percent levels by the end of the year.

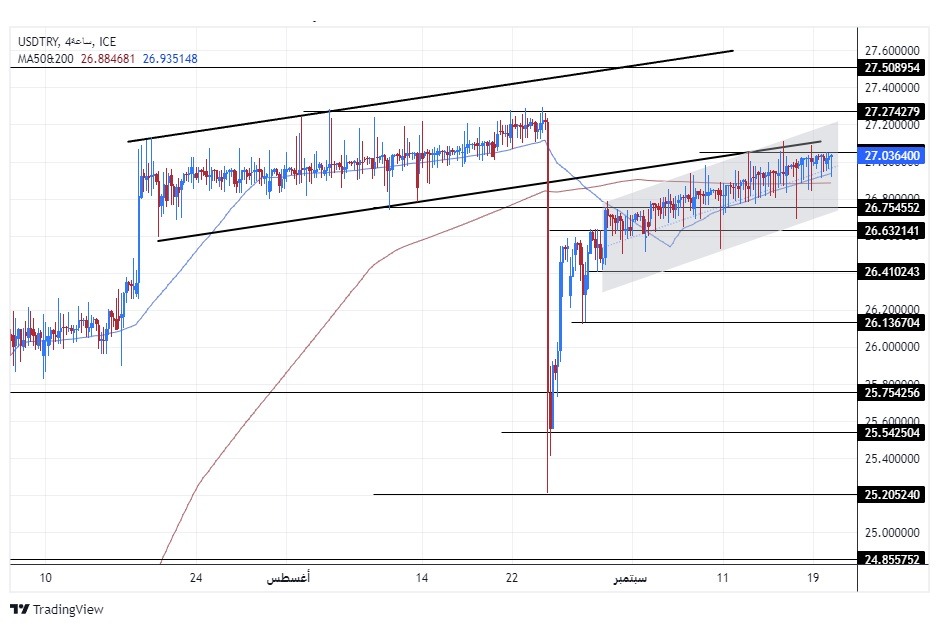

On the technical level, the dollar pair against the Turkish lira stabilized in a narrow range with a slight rise, with the pair continuing to trade within the ascending price channel on the 60-minute time frame shown in the chart, within the general upward trend, as the pair retested the lower border of the channel. The biggest bullish price on the 4-hour time frame was broken earlier last month.

Currently, if the pair goes up, it targets the resistance levels concentrated at 27.27 and 27.50, respectively, while if the pair declines, it targets the support levels concentrated at 26.50 and 26.13, respectively. The price moves around the 50 and 200 moving averages on the daily time frame, and the pair also trades between these averages on the four-hour time frame, as well as on the 60-minute time frame, in reference to the variation recorded by the pair in the short term.

The pair is expected to record some limited gains as long as it settles within the ascending price channel range. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.

[ad_2]