[ad_1]

Forex Brokers We Recommend in Your Region

See full brokers list

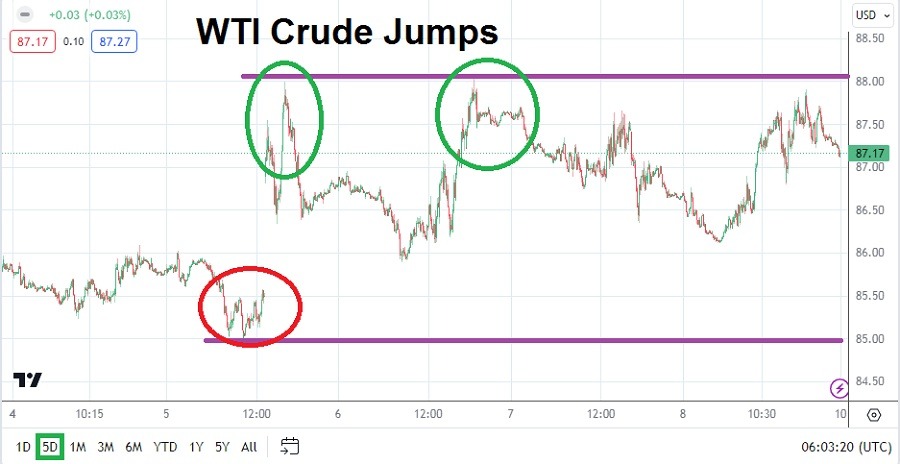

WTI Crude Oil went into the weekend near a price of 87.200 USD as news about production cuts from Saudi Arabia and Russia certainly affected trading last week.

On the 28th of June, the price of WTI Crude Oil was trading below the 67.000 price momentarily. Two and half months later the price of the world’s most important energy source is challenging ten-month highs and is near the 87.200 mark. News about production cuts from Saudi Arabia and Russia last week created additional firepower for WTI Crude Oil.

Global market behavior which has been nervous because of the stronger USD now has another worry to add to the list as this week of trading begins. A WTI Crude Oil price that has shown a significant bullish trend should catch the eye of speculators. Traders who believe there is additional opportunity for a higher move in WTI cannot be blamed. While China’s economic situation is certainly a concern, the U.S. has managed to keep its economic engine creating growth, and demand for energy is not decreasing.

Traders who have been watching the price of WTI have seen the value of the energy increase since late August when the 80.000 USD price was penetrated higher and sustained. Adding a bolt of velocity to the price of WTI early last week occurred when Saudi Arabia acknowledged it would cut back on production due to concerns about a lower demand outlook. While it may seem odd for traders that worries about a global recession would spark a higher Crude Oil price the potential of decreased supply concerns last week caused speculative buying.

- Global economic concerns are important, but if WTI Crude Oil remains above the 87.000 early this week it could cause additional nervous buying of the commodity to build.

- Traders looking for a downside in WTI Crude Oil may be proven correct mid-term, but nervous financial markets have caused volatile results to be seen in many assets, and perhaps WTI Crude Oil will feel this effect too.

- Speculators who are targeting higher values and dreaming about the 90,000 USD price to be challenged should not get overly ambitious.

While many traders may believe there is plenty of reason to suspect a downturn in the price of WTI will develop, pinpointing this reversal lower may prove dangerous and expensive. Yes, Saudi Arabia certainly cut back on production because it is worried about a decrease in demand, but speculative elements are worried about supply short falls in the near-term. This has led to a higher price and speculative buying of WTI. With the price of 90.000 USD within sight, traders should be prepared for a lot of noise to emerge from market watchers and this may cause further near-term volatility.

Speculative price range for WTI Crude Oil is 83.000 to 92.100 USD.

The WTI Crude Oil market is trading with a large dose of nervous sentiment and this has caused the commodity to go into the weekend near highs that are challenging values not seen since November 2022. In October and November of last year, the price of WTI did trade near 93.000. Nervous buying could certainly propel the commodity higher this week. Fundamental traders may insist that China’s economic data is showing a downturn, but that doesn’t necessarily mean the nation will suddenly stop buying supply. The U.S. economic picture is just as complicated and while a recession in the U.S. has been widely anticipated, a significant downturn has not materialized.

Short-term traders of WTI Crude Oil need to remain alert and they may want to continue to wager on upside price action. The trend higher in the energy source has been strong and can clearly be seen when looking at three-month charts. While there is reason to suspect a reversal will occur in Crude Oil because of the potential of pressures developing on the major global economies, demand has not decreased and news of less supply may keep speculative buying rather strong in the near term.

[ad_2]