[ad_1]

Forex Brokers We Recommend in Your Region

See full brokers list

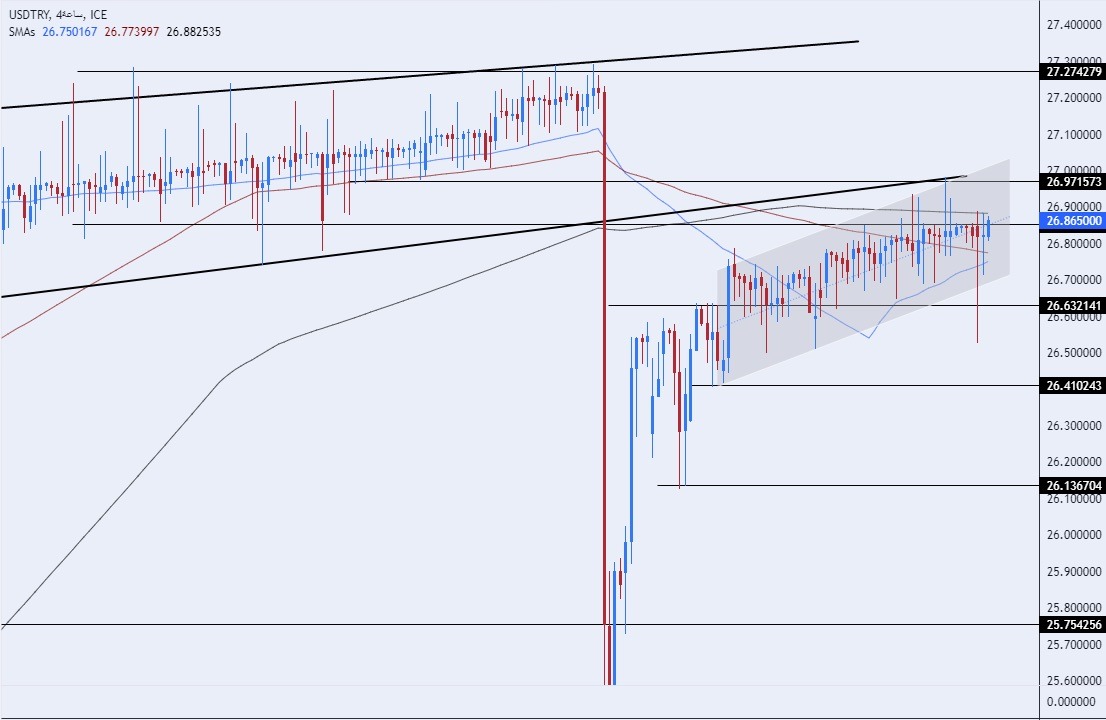

Risk 0.50%.

- Entering a buy order pending order from the 25.35 level.

- Place a stop loss point to close below the 24.95 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 27.00.

- Entering a sell deal with a pending order from the 27.00 level.

- The best points to place a stop loss are closing the highest level of 27.65.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 25.70.

The USD/TRY recorded movements within a limited range during trading at the beginning of the week. At the end of last week, Fitch Ratings Agency issued its report, which included raising the agency’s expectations for future foreign exchange reserves in Turkey to a stable outlook, while confirming the credit rating at the B level. The agency attributed this improvement to the shift in monetary policies in the country, which supports financial stability.

The Turkish Central Bank witnessed changes after the last presidential elections, as it appointed Hafiza Ghaya Arkan, a member of the traditional school, to the position of head of the bank, which raised interest rates over the course of three meetings from 8.5 percent to 25 percent, as part of the country’s fight against interest rates. Inflation has been expanding over the past months, as inflation recorded 58.9 percent last August compared to 47 percent recorded in July and 39 percent recorded last June.

At the same time, the Turkish government reduced growth expectations for the current and next year, while raising its expectations for inflation rates to reach 65 percent by the end of this year, compared to 25 percent.

On the technical level, the dollar pair traded against the Turkish lira, recording slight changes. The pair reached its movement within the boundaries of the ascending price channel on the 60-minute time frame, within the general upward trend, as the pair is heading to retest the lower border of the larger ascending price channel on the four-hour time frame, which he broke it earlier last month after settling inside it over several weeks.

If the pair rises, it targets the resistance levels concentrated at 27.00 and 27.50, respectively, while if the pair declines, it targets the support levels concentrated at 26.60 and 26.13, respectively. The price is moving above the 50, 100, and 200 moving averages on the daily time frame, while the pair is trading between these averages on the four-hour time frame, as well as on the 60-minute time frame, indicating the divergence that the pair is recording in the short term. The pair is expected to record some gains as it targets retesting the lower border of the price channel that the price broke before resuming the decline. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best regulated forex brokers UK in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best regulated forex brokers UK in the industry for you.

[ad_2]