[ad_1]

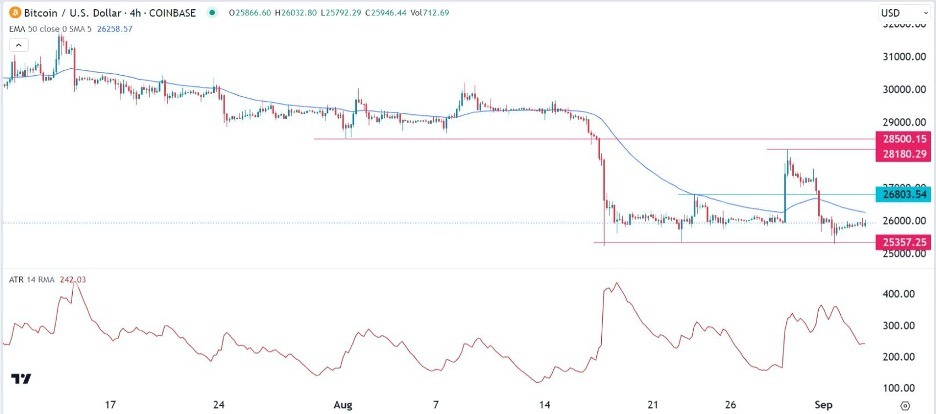

The pair has moved slightly below the 50-period moving average and the support at 26,803 (August 23rd high).

Forex Brokers We Recommend in Your Region

See full brokers list

- Set a sell-stop at 25,700 and a take-profit at 25,000.

- Add a take-profit at 26,800.

- Timeline: 1-2 days.

- Set a buy-stop at 26,300 and a take-profit at 27,300.

- Add a stop-loss at 25,000.

Bitcoin suffered a harsh reversal last week after a series of major ETF-related events. The BTC/USD pair was hovering at 26,000 on Monday, where it has been at in the past few days. This price is about 8% below the highest point last week.

Bitcoin price jumped sharply on Wednesday after Grayscale won a major ruling against the Securities and Exchange Commission (SEC). An American court ruled that the SEC needed to do a review of the company’s plan to convert the Grayscale Bitcoin Trust into an ETF.

Grayscale believes that an ETF is better than a trust because it will help narrow the discount that has existed over the years. Therefore, analysts believe that the SEC will ultimately decide to give the go-ahead for the conversion.

Bitcoin’s rally was short-lived after the SEC decided to delay its decision about ETF proposals by companies like Blackrock and Invesco. The SEC needs more time to review the Grayscale ruling and the measures these companies have put to reduce manipulation.

The most likely scenario is where the SEC accepts these ETFs because all companies have added a surveillance clause. Such a move will likely lead to more institutional investors allocating funds to the coin.

There is a sense in which Bitcoin lacks a clear catalyst this week. For one, there are signs that investors are moving to higher-yielding assets like certificates for deposits (CDs) and money market funds, which are yielding over 5%.

Bitcoin’s volume and volatility will likely be limited on Monday since most Americans will be away from the market as they celebrate Labor Day. For the remaining part of the week, the key events to watch will be speeches by several Fed officials and the release of the Beige Book.

The 4H chart shows that the BTC/USD pair rose to 28,180 on August 29th and then suffered a reversal to a low of 25,357 on 1st September. The pair has moved slightly below the 50-period moving average and the support at 26,803 (August 23rd high). The Average True Range (ATR) has dropped to the lowest point since Thursday.

Therefore, the pair will likely remain in this range on Monday as investors wait for the next catalyst. The key support and resistance levels to watch will be at 25,000 and 26,800.

Ready to trade our daily Forex signals? Here’s a list of some of the best crypto brokers to check out.

Ready to trade our daily Forex signals? Here’s a list of some of the best crypto brokers to check out.

[ad_2]