[ad_1]

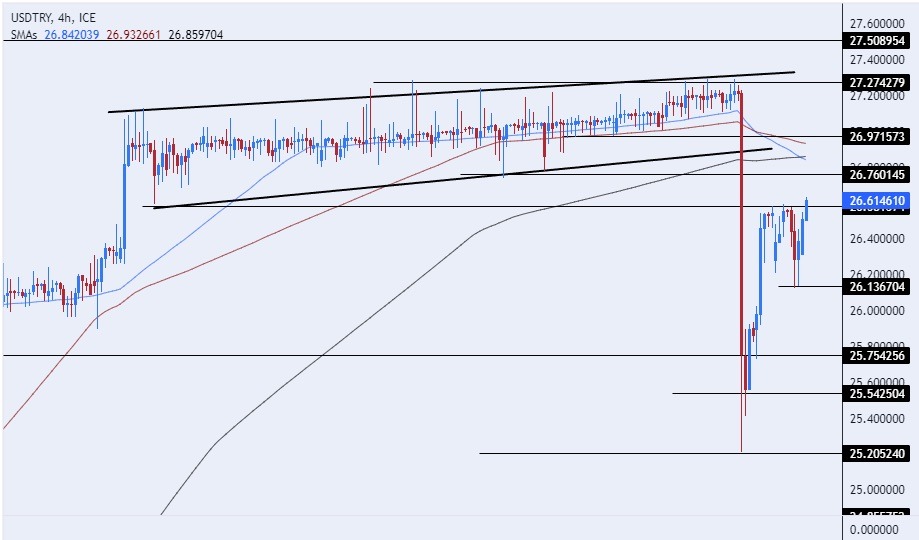

On the technical front, the dollar pair traded slightly against the Turkish lira on Monday, as the pair is heading to retest the lower border of the bullish channel on the four-hour time frame, which it broke during the racing week, after settling inside it for several weeks.

Forex Brokers We Recommend in Your Region

See full brokers list

The risk is 0.50%.

- Entering a buy order pending order from the 25.35 level.

- Place a stop loss point to close below the 24.95 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the remaining contracts until the strong resistance level at 27.00.

- Entering a sell order pending order from the 27.00 level.

- The best points to place a stop loss close to the highest level of 27.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 25.70.

The USD/TRY rose during early European trading this morning, Tuesday, amid the absence of economic data, as the markets are still absorbing the impact of the strong tightening practiced by the Turkish Central Bank during the current period. The lira jumped against the dollar by about 7 percent during trading last Thursday, after the decision of the Central Bank of Turkey to raise interest rates by about 750 basis points, bringing the main interest rate to 25 percent, which is a surprising decision for the markets, which were expecting to raise the interest rate by about 250 points.

After the rise last Thursday, the lira lost about 50 percent of its gains, as experts believe that the monetary and financial policymakers in the country still have a lot to shift completely from the unconventional monetary policy that the Turkish president was insisting on at the end of his previous term. Experts believe that the central bank’s goal of the strong hike is to absorb any negative impact regarding its attempt to get rid of lira deposits that are protected from fluctuations in the foreign exchange rate, as well as to control inflation, about which pessimistic expectations were issued by the Turkish Central Bank itself.

On the technical front, the dollar pair traded slightly against the Turkish lira on Monday, as the pair is heading to retest the lower border of the bullish channel on the four-hour time frame, which it broke during the racing week, after settling inside it for several weeks. If the pair rises, it will target the resistance levels that are concentrated at 27.00 and 27.50, respectively, while if the pair declines, it will target the support levels that are concentrated at 26.00 and 25.70, respectively.

The price moves above the moving averages 50, 100, and 200 on the daily timeframe, while the pair trades below these averages on the four-hour timeframe, while the pair trades between these same averages on the 60-minute timeframe, in a sign of the divergence recorded by the pair in the short term. The pair is expected to record some gains, as it aims to retest the lower boundary of the price channel, which was broken by the price, before resuming the decline. Please adhere to the figures in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.

[ad_2]