[ad_1]

According to the latest data, those deposits represented nearly a quarter of the volume of deposits in the country, at a value of $124 billion.

Forex Brokers We Recommend in Your Region

See full brokers list

The risk is 0.50%.

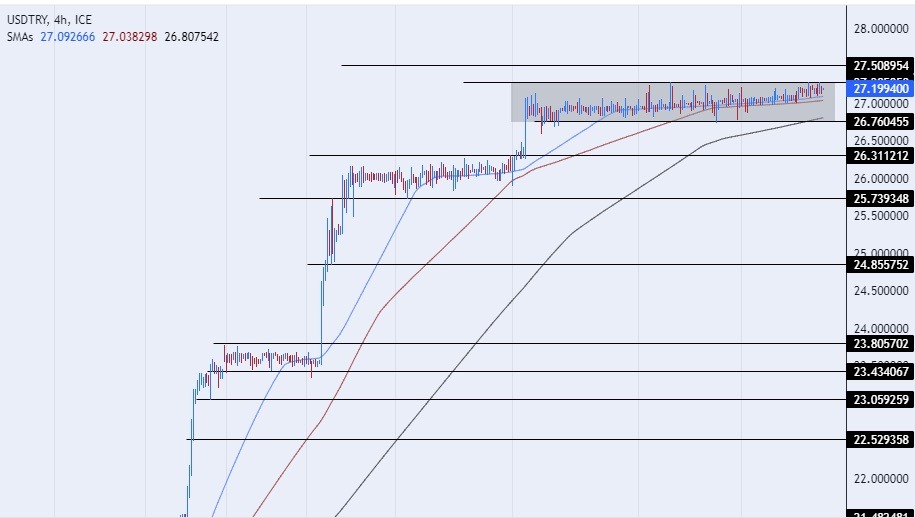

- Entering a pending order from the 26.50 level.

- Place a stop loss point to close below the 26.25 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 27.50.

- Entering a sell order pending order from the 27.50 level.

- The best points to place a stop loss close to the highest level of 27.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 26.50 support level.

The USD/TRY rose slightly, as the pair moved towards its highest levels ever, with continued pressure on the Turkish currency and stock markets in the country after the latest measures of the Turkish Central Bank, which aimed to reduce the volume of deposits in Turkish lira, which are protected from fluctuations in the foreign exchange rate.

The shares of banks in Turkey recorded a recovery at the end of last week after signals from Moody’s about the positive outlook for Turkish banks, but the shares of those banks suffered great losses in the wake of the central bank’s decision issued at the beginning of this week, which obligated banks operating in the country to buy more. of government bonds in the event that it did not reach its target of transferring the protected deposits, which were approved at the end of 2021 and known in the Turkish language as “KKM” (KKM), with the aim of reducing the volume of those deposits, which represent pressure on the volume of foreign exchange reserves with the bank.

According to the latest data, those deposits represented nearly a quarter of the volume of deposits in the country, at a value of $124 billion. The Central Bank’s move comes within the framework of its endeavor to shift to a more traditional monetary policy, as it has followed a number of measures over the past months, the most prominent of which was raising interest rates as part of its efforts to control the high inflation rate in the country.

On the technical level, the dollar pair rose against the Turkish lira, near its lowest levels ever during early trading on Wednesday morning, as the pair traded at levels of 27.29 lira per dollar, which is the highest level the pair has recorded since nearly a month. In general, the pair settled in mixed trading for the fifth week. respectively. If the pair rises, it will target the resistance levels that are concentrated at 27.50 and 28.00, respectively, while if the pair declines, it will target the support levels that are concentrated at 26.50 and 26.00, respectively.

The price is moving above the moving averages 50, 100, and 200 on the daily time frame, while the pair is trading between these averages on the four-hour time frame, as well as the 60-minute time frame, in a sign of divergence in the short term. The Turkish currency is expected to record some decline, especially if the pair breaks the upper border of the rectangle that the pair is trading inside. Please adhere to the figures in the recommendation, while maintaining capital management.

[ad_2]