[ad_1]

In the meantime, investors followed the statements of Turkish President Recep Tayyip Erdogan, issued on Monday, in which he said that the high inflation rate in the country is “temporary.”

Forex Brokers We Recommend in Your Region

See full brokers list

The risk is 0.50%.

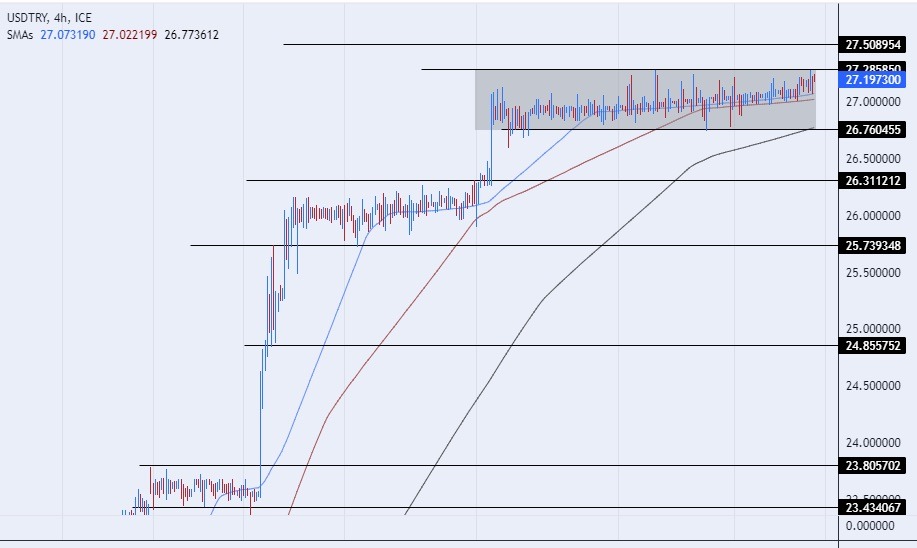

- Entering a buy order pending order from the 26.50 level.

- Place a stop loss point to close below the 26.25 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 27.50.

- Entering a sell order pending order from the 27.50 level.

- The best points to place a stop loss close to the highest level of 27.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 26.50.

The USD/TRY stabilized near its highest levels ever, while the shares of Turkish banks recorded strong declines during the trading at the beginning of the week, as the stock market on the Istanbul Stock Exchange closed deep in the red zone after recording a decline of 5.4%. The banking sector contributed to the declines and the shares of those banks had recorded a big jump at the end of last week after the credit rating agencies praised the banks in Turkey.

While bond prices rose, the yield on government bonds for 10 years fell 88 basis points, which is the largest decline since the presidential elections. This is after the Turkish Central Bank approved measures aimed at reducing lira deposits that are protected from foreign currency fluctuations.

In the meantime, investors followed the statements of Turkish President Recep Tayyip Erdogan, issued on Monday, in which he said that the high inflation rate in the country is “temporary.” Speaking after a cabinet meeting, Erdogan insisted that the government and singled out the new economic team will work to “remove inflation from the daily life” of the Turkish people, but asked citizens to “be patient a little bit”. According to the latest data, Turkey’s annual inflation rate reached 47.83% in July, marking an increase from the previous month’s rate of 38.21%.

On the technical level, the dollar pair against the Turkish lira maintained its stability without major changes, as it traded in the same range around the levels of 27 lira per dollar. The price settled near its highest levels recorded for nearly a month, as the pair is currently trading in a mixed manner for the fifth week in a row.

If the pair rises, it will target the resistance levels that are concentrated at 27.50 and 28.00, respectively, while if the pair declines, it will target the support levels that are concentrated at 26.50 and 26.00, respectively. The price is moving above the moving averages 50, 100, and 200 on the daily time frame, while the pair is trading between these averages on the four-hour time frame, as well as the 60-minute time frame, in a sign of divergence in the short term.

The Turkish currency is expected to record some decline, especially if the pair breaks the upper border of the rectangle that the pair is trading inside. Please adhere to the figures in the recommendation, while maintaining capital management.

[ad_2]