[ad_1]

The EUR/USD pair has remained in a tight range this week as focus remained on the credit rating downgrade of some American banks.

Forex Brokers We Recommend in Your Region

See full brokers list

- Sell the EUR/USD pair and set a take-profit at 1.0910.

- Add a stop-loss at 1.1045.

- Timeline: 1 day.

- Set a buy-stop at 1.100 and a take-profit at 1.1100.

- Add a stop-loss at 1.0910.

The EUR/USD exchange rate was flat on Thursday as traders wait for the upcoming US consumer price index (CPI) data. The pair was hovering at 1.100, where it has been at this week.

The EUR/USD pair has remained in a tight range this week as focus remained on the credit rating downgrade of some American banks. This downgrade led to a risk-off sentiment, which pushed stocks sharply lower and the US dollar index higher.

The pair also reacted to last Friday’s jobs numbers, statements by Fed officials, and weak Chinese economic numbers. Data published on Friday revealed that the economy created over 187k jobs in July while the unemployment rate dropped to 3.5%.

Several Fed officials delivered mixed statements about the future of interest rate hikes. In her statement, Michele Bowman argued that more rate hikes were necessary since inflation remains higher than 2%. In a separate statement, Patrick Harker said that the Fed could now pause its hikes.

The next important data to watch will be the latest US consumer inflation data. Economists polled by Reuters expect the data to reveal that the headline consumer price index (CPI) rose by 0.2% in July, leading to a YOY increase of 3.3%. Inflation rose by 0.2% in June, leading to a 3.0% annual increase.

Core inflation, on the other hand, is expected to come in at 0.2% and by 4.7% on a YoY basis. If these estimates are accurate, it means that inflation is still stubbornly high, which could lead to more tightening in the coming months.

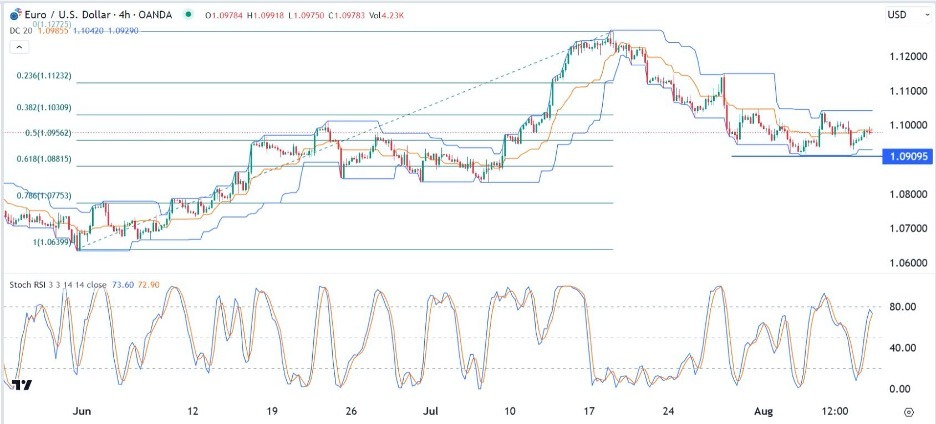

The EUR/USD pair drifted upwards ahead of the US consumer inflation data. It was trading at 1.0980, which was along the middle line of the Donchian Channels indicator. The pair has moved slightly above the 50% Fibonacci Retracement level.

In addition, the pair’s stochastic RSI has pointed upwards and is nearing the overbought level. Therefore, the outlook for the pair is bearish, with the next important support level to watch will be at 1.0910, the lowest level last week.

On the other hand, a move above the key resistance level at 1.1038, the upper side of the Donchian Channels will point to more upside.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex trading platforms to check out.

[ad_2]