[ad_1]

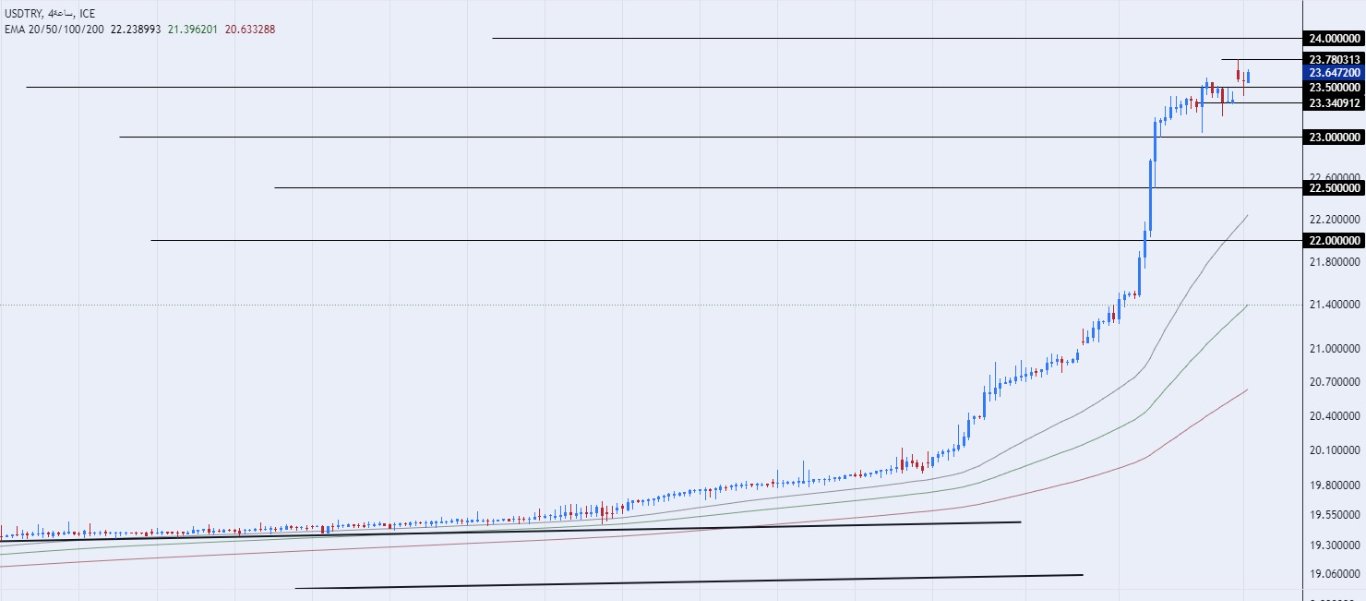

The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend.

The risk is 0.50%.

- Entering a buy order pending order from the 23.20 level.

- Place a stop loss point to close below the 23.00 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 23.50.

- Entering a sell order pending order from the 24.00 level.

- The best points for placing a stop loss close to the highest level of 24.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 23.50.

The Turkish lira continued its losses against the US dollar at the beginning of the new week, as the Turkish currency continued its rapid losses against the dollar for a period of about a month. Several reports revealed expected adjustments in interest rates in Turkey during the upcoming central bank meeting, expected on the 22nd of this month, as the interest rate may be raised for the first time in several years after pursuing an unconventional monetary policy by Turkish President Recep Tayyip Erdogan, which appears to be He may turn against his unconventional policy after Muhammed Simsik assumed the Ministry of Finance in the country, while Hafiza Ghaya Arkan rose to the post of head of the Central Bank of the country, and they are descendants of the traditional theory in economics based on raising interest rates to reduce inflation.

The latest reports issued by international investment banks stated that interest rates may be raised in the country to reach levels of 25% from the current rate of 8.5%, which was approved by the Central Bank several months ago. till then. In other news, it was reported that the newly appointed Finance Minister may unveil a new 500-lira banknote, a denomination in line with the country’s current inflation rate. As for the data, it was issued early this morning. The unemployment rate in the country increased on a monthly basis last April, reaching 10.2%, compared to 10.00% recorded in March. The expected reversal in monetary policy may support the price of the lira, as it is expected that the price will witness a strong movement in the event that interest rates are raised.

On the technical front, the dollar pair continued to rise against the Turkish lira within the pair’s trading in a strong general bullish trend that continued for about a month, with the pair recording new levels on a daily basis without any significant corrections, although it was noticeable that the momentum of the lira’s decline was declining as it slightly exceeded 23 levels. The lira declined during early trading this morning, as the pair reached 23.78 levels. At the same time, the pair is trading above the support levels that are concentrated at 23.50 and 23.00, respectively. The price also settles below the resistance levels that are concentrated at 24.00 and 24.50.

The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. Even announcing the expected changes in monetary policy, any fall in the dollar against the lira represents an opportunity to buy back again. Please adhere to the figures in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here’s a list of regulated forex brokers to choose from.

[ad_2]