[ad_1]

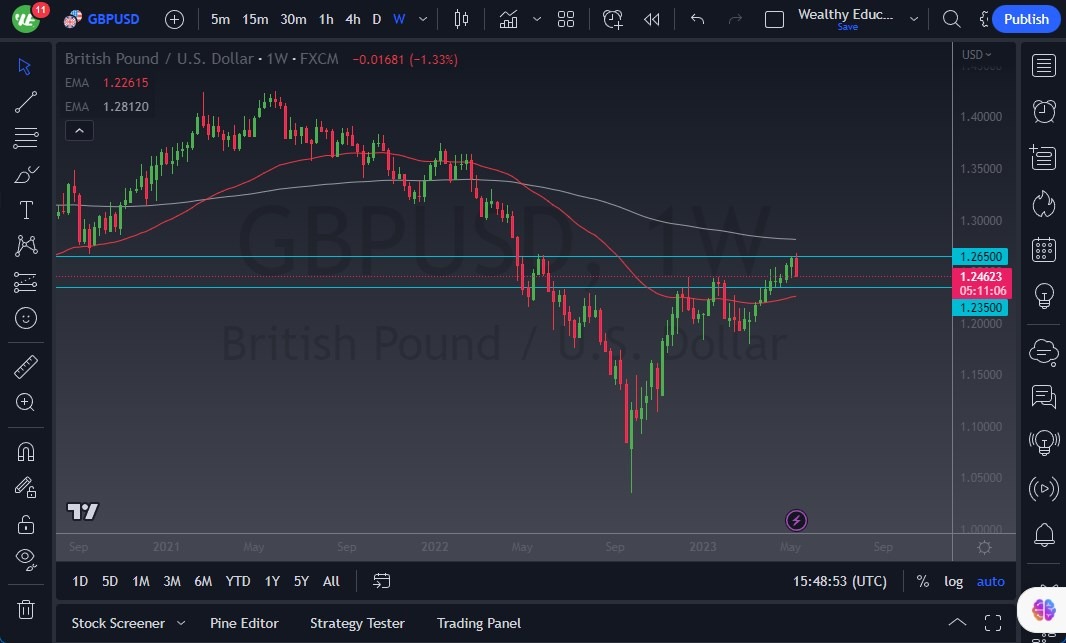

The British pound gave up significant momentum and fell hard during the week, as the 1.2650 level has offered a major barrier. That being said, the 1.2350 level underneath also offer support, so this may be a market that will find buyers over the next several sessions, and therefore I think we are trying to figure out whether or not we are going to go back and forth in the same 200 points that we have been in over the last 6 weeks.

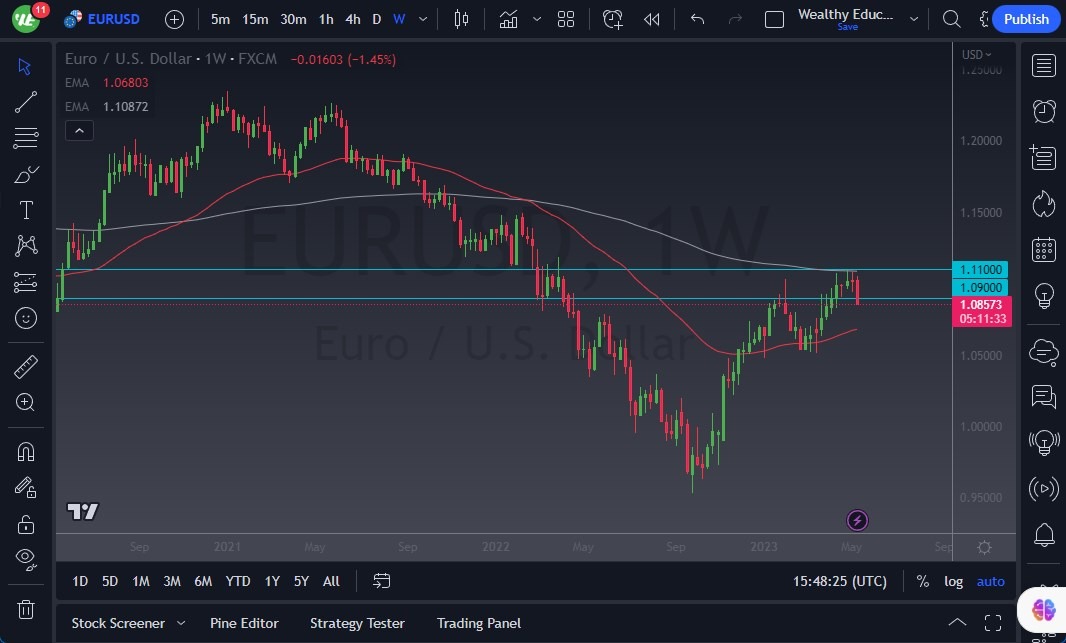

The euro has sliced through support during the week, pulling back from the 200-Week EMA. At this point, the market breaking below the 1.09 level opens up the possibility of a move down to the 1.07 level. Ultimately, this is a situation where I think eventually that buyers will come back into this market, but we may have a week or 2 of negativity. The 1.05 level underneath is a significant amount of support just waiting to happen, so we may be trying to carve out a range for the summer.

The US dollar has bounced significantly from the 1.33 level, an area that has been in massive support multiple times. The 50-Week EMA sits just below the candlestick for the week and should offer some support. On the other hand, the 1.38 level above is a major resistance barrier that will be very difficult to get above. If we do break above the 1.38 level, this pair could really start to take off to the upside. Pay close attention to the oil markets, because they will have an influence on the Canadian dollar as well.

The Australian dollar initially tried to rally during the past week, but it touched the 50-Week EMA and then fell rather precipitously. At this point, the 0.66 level will almost certainly be tested. If we can break down below there on a daily close, it’s likely that the Aussie dollar will continue to fall, perhaps reaching down to the 0.64 level. If we do hold the 0.66 level, then it’s possible that we could bounce back toward the 0.68 level. While I believe that consolidation may be the norm, this last week has been particularly ugly.

The Canadian dollar has fallen a bit against the Japanese yen to test the 50-Week EMA, before turning around to show signs of life. At this point, I believe that the ¥102.00 level is an area that we need to pay close attention to as it has been both significant support and significant resistance in the past. If we break above that level, then I believe that the Canadian dollar will eventually try to reach the highs against the Japanese yen as well. Furthermore, it is probably worth noting that the Japanese yen is on its back foot against most currencies.

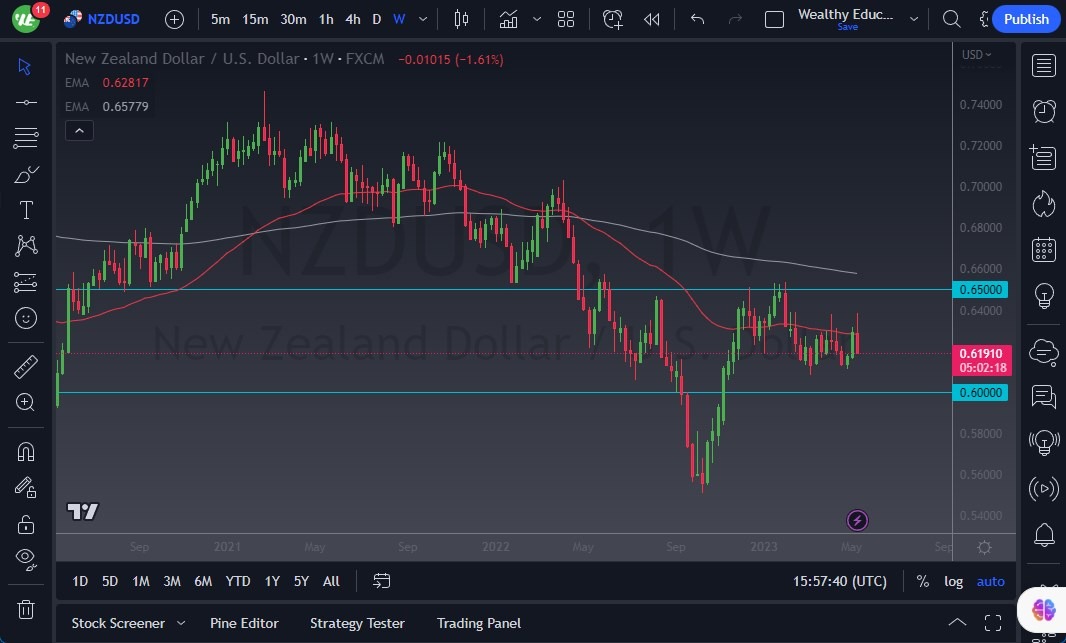

The New Zealand dollar has had a rather noisy week, as we initially tried to reach the 0.64 level, before turning around and showing signs of exhaustion. The market could very well be trying to break down through the support just underneath, opening up the possibility of a move down to the 0.60 level. The market has been very noisy, and therefore I think we are trying to figure out what we are going to be doing going forward. Ultimately, it looks as if the New Zealand dollar is struggling, and it’s probably worth noting that the US dollar has shown itself to be very resilient this past week.

The US dollar initially fell during the week but found enough support underneath the turnaround and start rallying again. That being said, the ¥138 level above ends up being a massive resistance barrier, and if we can break above there, then it’s likely that the market is looking to the ¥140 level. Furthermore, you can make an argument that the “measured move” of the triangle suggests that we could go as high as the ¥148 level above. All things being equal, the 50-Week EMA underneath should continue to offer support as well. While I don’t necessarily think this market simply takes off to the upside without any hesitation, the reality is that the interest rate differential between the 2 currencies will continue to favor the US dollar.

The US dollar has turned around completely against the Swiss franc during the course of the week but still sees a bit of noise just above and to the 0.90 level. If we can break above there, then it’s likely that the market could go looking to the 0.92 level. If we break above, the 0.94 level would be the next target. On the other hand, the 0.88 level underneath being broken would be a major turn of events, as it is a huge support level on longer-term charts. All things being equal, we are looking at either consolidation or break higher more than anything else.

[ad_2]