[ad_1]

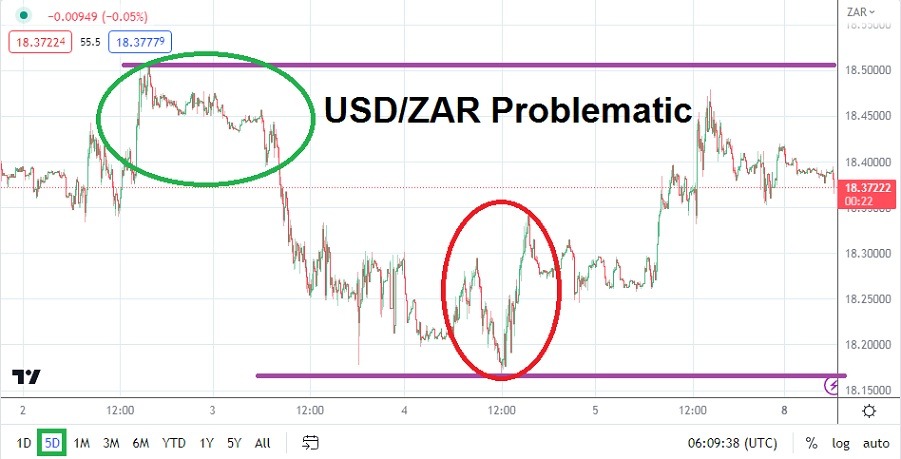

The volatility within the USD/ZAR displayed in the past handful of days is likely to remain a part of the coming trading landscape.

The USD/ZAR has begun this week of trading within the higher elements of its one-week price range after experiencing volatile results the past four days.

As of this writing the USD/ZAR is near the 18.35500 ratio with fast results flickering on trading platforms. Speculators of the USD/ZAR were given a reminder last week that the currency pair can be a troubling and problematic trade when proper risk management is not used. The USD/ZAR traded below the 18.17000 level on early Thursday after the U.S Federal Reserve’s interest rate announcements. However, the USD/ZAR began to track higher again and showed that nervousness likely remains high regarding domestic economic issues in South Africa.

Financial institutions certainly expected the interest rate hike from the U.S Fed and this helped create some bearish momentum in the USD/ZAR. But within a handful of hours, the USD/ZAR began to climb again and by early Friday the currency pair was around the 18.48000 ratio momentarily. The higher price range of the USD/ZAR remains rather ‘sticky’ technically and traders should be cautious.

The volatility within the USD/ZAR displayed in the past handful of days is likely to remain a part of the coming trading landscape. The U.S. Federal Reserve created the notion that the U.S. central bank may ‘pause’ interest rate hikes, but they did not make a guarantee. Federal Reserve officials who are scheduled to speak early this week may sound rather cautious. Also, important U.S. inflation data will come from via the CPI statistics on Wednesday.

The USD/ZAR price range between 18.25000 and 18.45000 should be monitored in the near term. A move above the 18.40000 mark that is sustained should make speculators nervous and they may want to presume financial institutions are wary about South Africa’s economic conditions. The USD/ZAR has not correlated very well with the broad Forex market and this is another reason traders should be risk-averse.

- The mixture of U.S. inflation data coming in the middle of this week will cause a reaction in the USD/ZAR as Consumer Price Index statistics are examined.

- Nervous sentiment generated by ‘shadows’ over the South African government is keeping the USD/ZAR within its higher price range for the moment.

A lack of clarity from the U.S. Federal Reserve and domestic troubles in South Africa are likely to keep the USD/ZAR within its current higher price range near-term. Traders looking to take advantage of momentum up or down technically may have to be patient. Careful decisions regarding take profit and stop loss orders should be used. Quick-hitting targets may prove tempting, but the volatility within the USD/ZAR is likely to continue in the coming days and cause rather choppy results.

Current Resistance: 18.37800

Current Support: 18.32700

High Target: 18.44990

Low Target: 18.24600

Ready to trade our Forex daily analysis and predictions? Check out the top forex trading brokers in South Africa worth using.

[ad_2]