[ad_1]

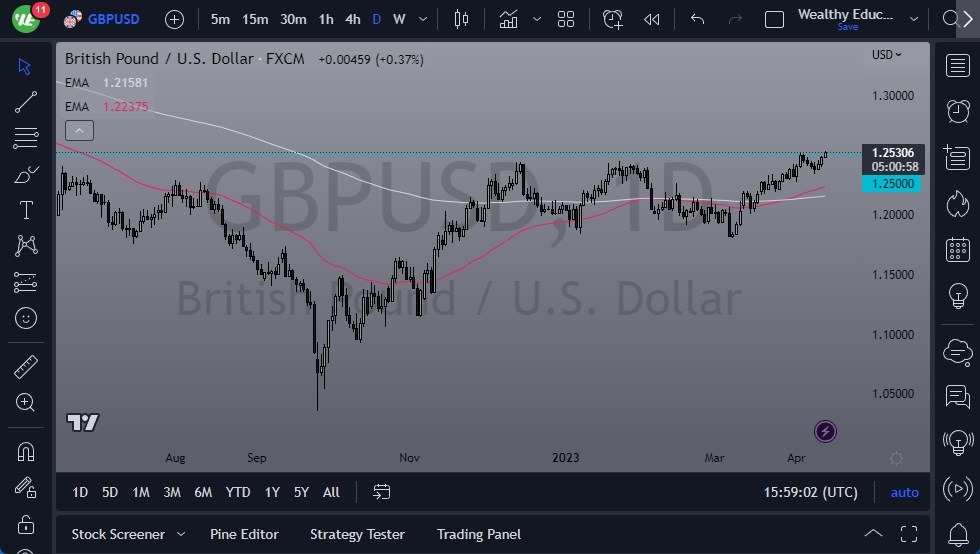

If the pound were to break down below the 1.24 level, the market could fall significantly, potentially down to the 50-Day EMA at the 1.2250 level, where there is expected to be dynamic support.

- The GBP/USD has continued to rally during the Thursday trading session, breaking above the key 1.25 level.

- This level is significant both structurally and psychologically, and as such, it’s been attracting a lot of attention from traders. While it’s clear that the pound is pushing higher, there is also significant selling pressure being experienced in the market.

- This could result in a lot of noise over the next few days, making it difficult for traders to take a definitive position. Further adding to the noise was the fact that the PPI numbers came out lower than expected in the United States, which adds yet more pressure on the greenback.

The next few sessions are crucial, and a close above the 1.25 level on the daily chart will likely send the pound towards the 1.2750 level, possibly as high as 1.30 in the coming weeks. Conversely, a “risk off” move could send the pound back to the 1.24 level, which could serve as support after previously acting as significant resistance. However, it’s best to wait for confirmation candles before taking a position, given the potential for significant volatility.

If the pound were to break down below the 1.24 level, the market could fall significantly, potentially down to the 50-Day EMA at the 1.2250 level, where there is expected to be dynamic support. Alternatively, there could be even more support around the 1.22 level, where the 200-Day EMA currently sits. Regardless of the scenario, the British pound is expected to remain a very noisy currency, given its strong bullish trend and the questions around inflation in the UK.

While there are concerns about inflation in the UK, the British pound is expected to perform better against the US dollar than other currencies. This trend has been observed throughout the year, and it’s expected to continue. Overall, the British pound is expected to remain a challenging currency for traders, with significant fluctuations expected in the coming days and weeks. After all, it seems like we are looking at a potential recession, and while there is a lot of “hopium” that the Federal Reserve is going to cut rates, the fact that the economy is slowing down will have people looking for safety sooner or later. With this, it will only continue to add to the volatility, making trading difficult.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]