[ad_1]

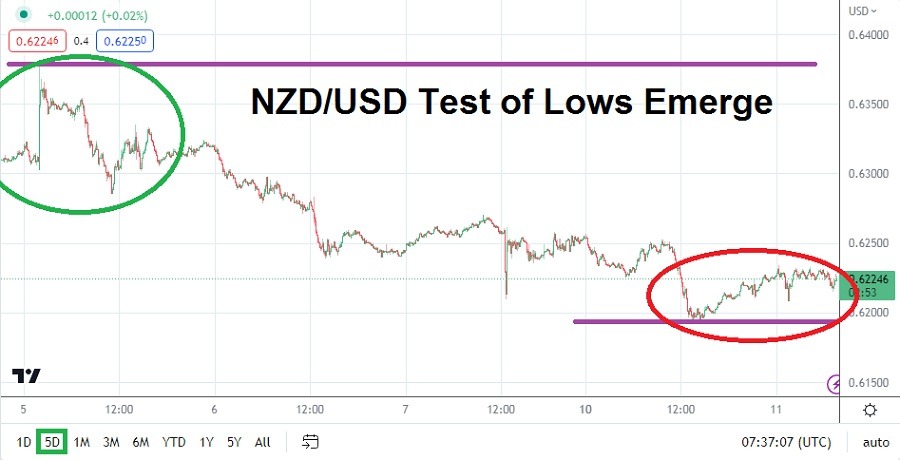

The NZD/USD is trading within sight of yesterday’s lows as financial houses appear to be preparing for the potential of unwelcome inflation numbers from the U.S. tomorrow.

The NZD/USD hit a low of nearly 0.61925 yesterday as financial houses delivered a sudden flurry of selling within the currency pair. Yesterday’s trading started out optimistically enough as the NZD/USD was near Friday’s marks of 0.62580, but upon larger amounts of Forex volume emerging as U.S financial houses started to return from their long holiday weekend things became bearish. On Wednesday of last week, the NZD/USD was trading near the 0.63810 ratios.

Trading evidence suggests that financial institutions are being risk-averse before tomorrow’s Consumer Price Index reports from the U.S., which will give solid insights regarding inflation. While many financial houses have appeared to have positioned for the U.S. Federal Reserve to become more dovish in the mid-term, nervous behavioral sentiment is clearly showing concerns remain regarding an interest rate hike in early May and the potential for another in June.

While the NZD/USD certainly moved lower yesterday while displaying strong selling, the currency pair has moved higher in early trading today. The currency price of the NZD/USD is around the 0.62200 mark which puts the currency pair within the middle of its range for the past month. Technical perception will be important per each speculator’s outlook because the NZD/USD is seemingly hovering over important support.

- The support levels of 0.62100 to 0.62000 should be watched closely in the near term. Following yesterday’s lows, if these support levels can prove durable it may indicate financial houses are waiting on the results of tomorrow’s U.S inflation statistics to react.

- The outcome of the Consumer Price Index reports tomorrow for the NZD/USD will cause volatility.

- Speculators who are inclined to trade before the publication of the CPI report while wagering on its results will need to have risk management working in totality.

Today will see a return of full Forex volumes within the global marketplace. Financial houses which have been leaning towards a less aggressive U.S Federal Reserve may be a bit nervous about their positions and this may cause further choppy conditions with the NZD/USD and other major currency pairs.

Traders should make sure their risk-taking is guided by solid take profit and stop loss orders. The technical notion the NZD/USD is within the middle of its one-month price range suggests that tomorrow’s U.S CPI results will have a profound effect on the currency pair, and speculators need to be braced for a strong reaction depending on the outcome of the inflation numbers.

Current Resistance: 0.62325

Current Support: 0.62125

High Target: 0.62550

Low Target: 0.61975

[ad_2]