[ad_1]

Ultimately, the direction of the Euro will depend on its ability to sustain its gains and break through key resistance levels.

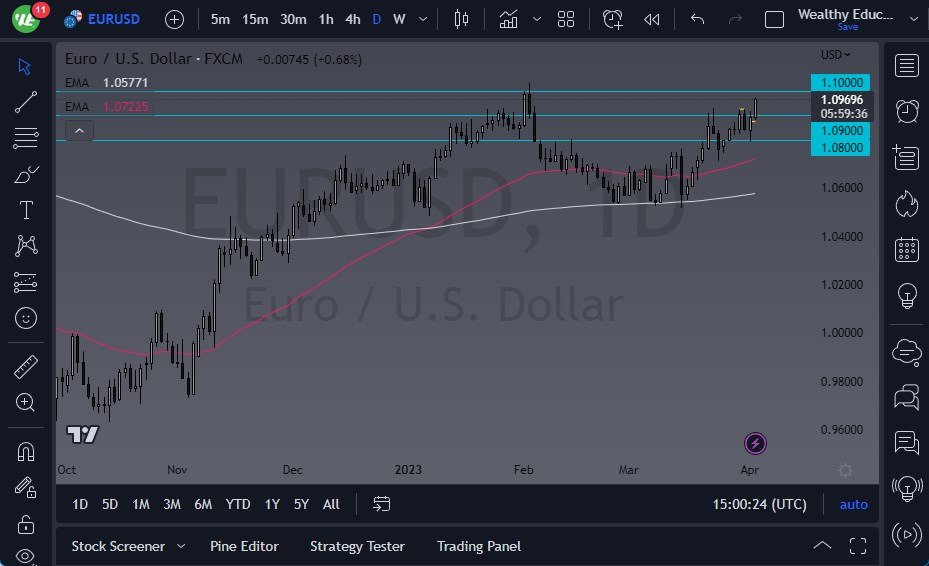

The Euro opened Tuesday’s trading session with a strong push upwards, breaking through the 1.09 level. However, the EUR/USD market is currently in an extreme high and it remains to be seen whether the gains will be sustained. The US dollar, on the other hand, is suffering at the hands of trader expectations around the interest-rate markets, and the possibility of interest rates falling further in America. While this trend could work against the US dollar, the Federal Reserve has indicated that inflation is not where they would like it to be, which could lead to disappointment in the market.

Despite these underlying fundamentals, the price remains the most important factor to watch. As a result, traders should keep a close eye on the area between the 1.09 and 1.10 levels, which has proved difficult to overcome in the past. If the Euro were to break down below the bottom of Monday’s candlestick, it would be a negative sign for the currency and could send the market reeling.

Over the next several sessions, traders should expect to see choppy and noisy behavior as they try to make sense of the market’s movements. Friday’s upcoming holiday for Good Friday, along with the Non-Farm Payroll announcement, could further complicate the situation, leading to a strange week in the market. With most markets closed on Friday, it is possible that traders may adopt a holding pattern until next week.

The Euro has its own challenges to contend with, but it appears that the European Central Bank will continue to be hawkish. Overall, this could mean that the week could end up being a bit of a wash for the currency. However, with the jobs situation in the US showing signs of slowing via the jobs report, means that it should continue to see a lot of chop in this area.

- At the end of the day, the Euro’s movements are being driven by a combination of factors, including expectations around interest rates and inflation, as well as broader market sentiment.

- While the currency has made a strong push upwards, traders should exercise caution and be prepared for volatility in the days ahead.

- Ultimately, the direction of the Euro will depend on its ability to sustain its gains and break through key resistance levels.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.

[ad_2]