[ad_1]

The EUR/USD has rallied a bit during the course of the trading week to reach the 1.09 level, but we also have seen it sell off a little bit towards the end of the week, and it is pressing a significant amount of resistance and more extensive than the 1.10 level. Because of this, I suspect that the next week or so could see more of a “fade the rally” type of situation, especially if we get some type of risk-off attitude around the world.

The GBP/USD has rallied significantly during the course of the trading week, but it does look as if we are struggling to take out the 1.24 handle. Because of this, I think it’s probably only a matter of time before we see sellers come back into the market and push it lower. Ultimately, we are essentially trading between the 1.24 level and the 1.1850 level, as it makes a nice strong consolidation area. We are at the top of that consolidation area, so it does suggest that we are going to see sellers come back.

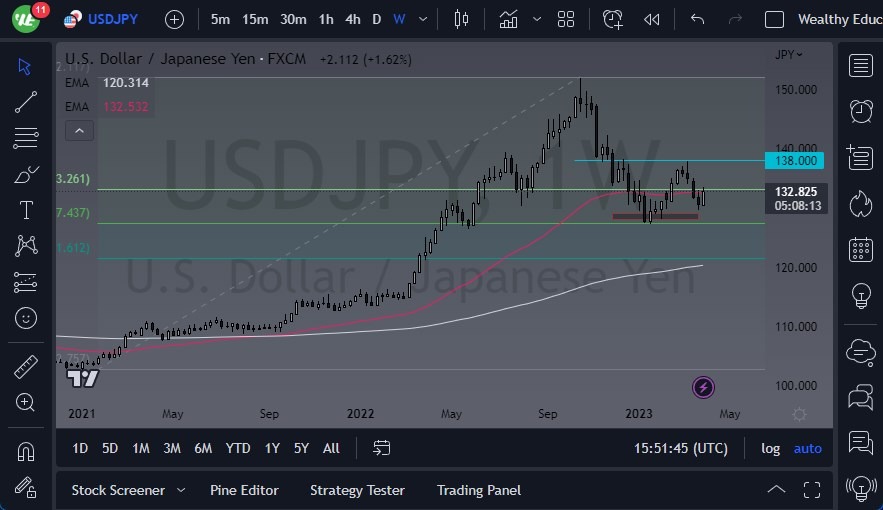

The USD/JPY has rallied a bit during the previous week, and it looks like we are trying to stick to that double bottom of support to turn things around. The market breaking above the top of the weekly candlestick opens up the possibility of a move to the ¥138 level, which is an area where we have seen selling pressure previously, so it makes for a nice target. If we can break above there, then we could really start to take off to the upside. Keep in mind that we will have to keep an eye on the 10-year JGB yield because as it rises, the Japanese yen loses strength.

The AUD/USD has rallied during the week, but we are still struggling with the same resistance barrier, between the 0.67 level in the 0.68 level. We are forming a little bit of a bearish pennant, so if we break down below the bottom of this weekly candlestick, then it’s likely that we could continue to drop. The “measured move” opens up the possibility of revisiting the lows. On the other hand, if we turn around a break above the 0.68 level, it could open up the possibility of a move to the 0.70 level.

The USD/CHF initially tried to rally against the Swiss franc but lost some of the momentum to the upside. At this point, it looks as if the market is trying to determine whether or not the support will hold, as the area between 0.91 and 0.90 continues to be a bit of a barrier. If we were to break down below the 0.90 level, then the market really could fall apart. On the other hand, if we break above the top of the weekly candlestick, then it’s likely that we could go looking to the 0.94 level above, which is the top of the recent consolidation area.

The USD/CAD has fallen during the week, as we go crashing into the 1.35 level. Underneath, there is the 50-Week EMA that is trying to take out the top of a triangle, and therefore it’s likely that we would find buyers underneath. That being said, any signs of support on a weekly candlestick could open up the possibility of turning around and rallying. That being said, if we break down below the 50-Week EMA, then it’s likely that the US dollar could drop down to the 1.30 level underneath.

The S&P 500 has rallied rather significantly during the week, and now is threatening to break out above the 4100 level. This is an area that extends to the 4200 level, and therefore it’s likely that we would see selling pressure somewhere in this general vicinity. If we break out above the 4200 level, then the market could go much higher. In that move, it would have this market entering a bull phase. That being said, I think it is going to struggle to go higher.

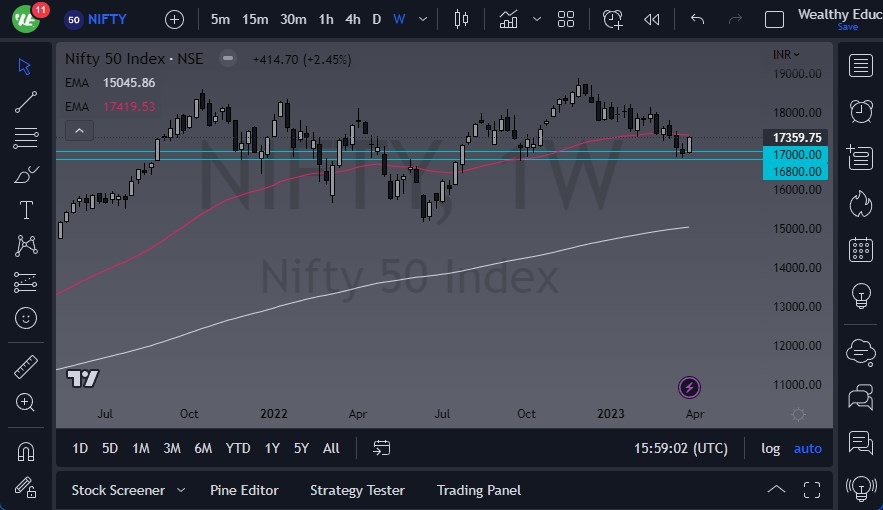

The Nifty 50 has rallied during the week, bouncing from a major support level. The ₹17,000 level is a significant support barrier, and now that we have pulled away from it so quickly, it suggests that the market is going to continue to see buyers underneath. If we can take out the 50-Week EMA, then it’s likely that the market goes looking to the ₹18,000 level. Anything above their opens up the possibility of a massive move higher.

Gold markets have fallen a bit during the course of the week, but then turned around to show signs of life again, just as it has done during the previous week. That being said, the area above $2000 is going to be very difficult to hang onto, so I think we will probably see more of a “buy on the dip” type of attitude. Underneath, the $1900 level is a potential support level if we do break it down.

[ad_2]