[ad_1]

Global risk sentiment slowly improved over the past week, with Friday’s lower-than-expected US Core PCE Price Index data giving a strong boost to stock markets as the week ended.

The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are a few valid long-term trends in the market right now, which might be exploited profitably. Read on to get my weekly analysis below.

I wrote in my previous piece on 26th March that the best trade opportunities for the week were likely to be:

- Long Gold against the USD following a daily close above $2,000.

- Long Bitcoin against the USD following a daily close above $30,000.

- Short of the USD/JPY currency pair following a daily close below ¥130.

- Long of the NASDAQ 100 Index following a daily close above 12820. This set up on Wednesday when the price closed above 12820, and the price closed Friday up by 2.70%.

None of the other trades are set up.

The news is dominated by three major issues:

- Lower than expected US Core PCE Price Index data. The Federal Reserve and other market participants pay close attention to this metric, with some preferring it to the official CPI rate as a measure of the inflationary tendency of the economy. Analysts were expecting a month-on-month rise of 0.4% but the figure came in at 0.3%, providing further evidence that inflation is falling after the previous week showed US CPI data doing the same. This is reinforcing expectations that there will be only one more rate hike in the current cycle, probably at the next Fed meeting, although the odds on no hike will have lengthened slightly. Following the data, we saw a broad surge in US stock markets, with the wider S&P 500 Index following the NASDAQ 100 Index, which has been on a firm bull run over recent days.

- A seeming end to the US banking crisis. After Credit Suisse was acquired by Swiss Giant UBS, there were no further bank failures and banking shares began to recover. Markets seem to have lost most of their fear about an escalation of the crisis.

- German inflation is not falling. Preliminary German CPI data showed a month-on-month increase of 0.8%, unchanged from the previous month and higher than the 0.7% increase which had been expected.

There were four other significant data releases last week:

- Australian CPI data – Australian inflation fell from an annualized rate of 7.4% to 6.8%, when 7.2% had been expected. This is a further sign that inflation in G20 nations is really starting to come down.

- US Final GDP data – this came in slightly lower than expected for the previous quarter, showing the US economy grew at an annualized rate of 2.6% compared to the 2.7% which had been expected.

- Canadian GDP data – the Canadian economy rebounded strongly from the previous month’s contraction, with GDP rising by 0.5%, exceeding the widely expected rate of 0.4%.

- US Consumer Confidence data – this came in more strongly than expected.

The coming week in the markets is likely to see a similar, or possibly higher, level of volatility compared to last week, due to a similar intensity of key data releases scheduled. This week’s key data releases are, in order of importance:

- US Non-Farm Payrolls, Average Hourly Earnings, and Unemployment Rate

- Australian Cash Rate and Rate Statement

- New Zealand Official Cash Rate and Rate Statement

- Swiss CPI data

- US JOLTS Job Openings data

- US Unemployment Claims data

- US ISM Manufacturing PMI data

- US ISM Services PMI data

- Canadian Unemployment data

Monday to Wednesday inclusive will be public holidays in China. Friday is a public holiday in Germany, the UK, Canada, Switzerland, Australia, and New Zealand.

The weekly price chart below shows the U.S. Dollar Index made another successive weekly decline, continuing the rejection of the key resistance level at 105.36 with a small bearish inside bar.

However, it is notable that the weekly candlestick has a small real body and a large lower wick, which again rejected a key support level. This suggests that we may be unlikely to see another decline over the coming week, despite the long-term bearish trend in which the Dollar is trading below its levels of both 3 and 6 months ago.

We saw a strong weekly rise in the NASDAQ 100 Index over the week after a golden cross was made on the daily chart three weeks ago. The Index closed Friday at a new 7-month high, rising fast after it finally made a bullish breakout beyond the key resistance level at 12820.

The candlestick is large and closed right at its high price – these are bullish signs. Another sign which might be bullish is that the broader S&P 500 Index finally made a convincing rise in tandem with the NASDAQ 100, suggesting that a bull market in US stocks may finally be truly taking off, especially following the lower-than-expected Core PCE data released on Friday, which should take a little pressure off the Federal Reserve.

There are no key resistance levels until 13735, so the price has room to rise over the coming week.

The NASDAQ 100 Index looks like a buy.

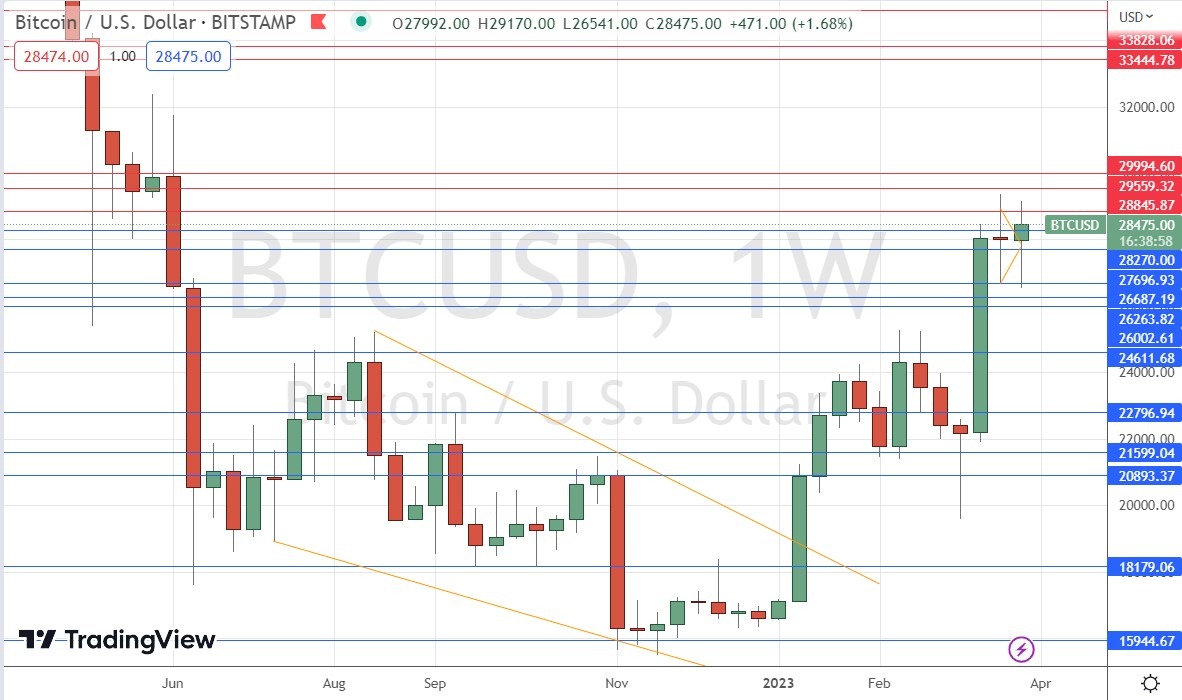

Last week saw the price of Bitcoin rise a little, following its slight fall over the previous week. This week’s candlestick is a near-doji, which suggests some indecision – yet it is still a bullish candlestick, even if a weak one.

The price is certainly in a bullish trend, having reached a new 9-month high price the week before last. The price was not able to make a new high last week, but it has held up and refused to decline. This, coupled with the bullish long-term trend, suggests it is worth remaining interested in Bitcoin on the long side.

Technically, the price chart below shows that the price still faces a cluster of three key resistance levels between the current price and the big round number at $30k. Traders might want to wait until we get a daily close above $30k and then go long, hoping for an explosive breakout. The price should then have room to rise to at least $33,400.

The GBP/USD currency pair rose for the fifth successive week, although the weekly candlestick shown within the price chart below exhibits a significant upper wick. It is important to note that this upper wick almost touched the key resistance level at $1.2437. This is a very, very key resistance level and represents (plus a few pips) the highest price in ten months.

There is no notable reason for the British Pound to be strong – you can see several other currencies also enjoyed rises against the US Dollar over the past week. There are signs that the trend against the greenback is slowing, however.

I highlight this currency pair because it is close to a major bullish breakout. If we get a daily close this week above $1.2437, I think it could make an excellent long trade entry, even though the actual long-term high is a few pips higher at $1.2448.

As some key markets are facing significant resistance levels against recent trends, I see the best trading opportunities this week as mostly likely to require confirmations:

- Long Bitcoin against the USD following a daily close above $30,000.

- Long of the GBP/USD currency pair following a daily close above $1.2437.

- Long of the NASDAQ 100 Index.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.

[ad_2]