[ad_1]

Traders need to look for signs of exhaustion that they can fade, as the market will continue to be noisy.

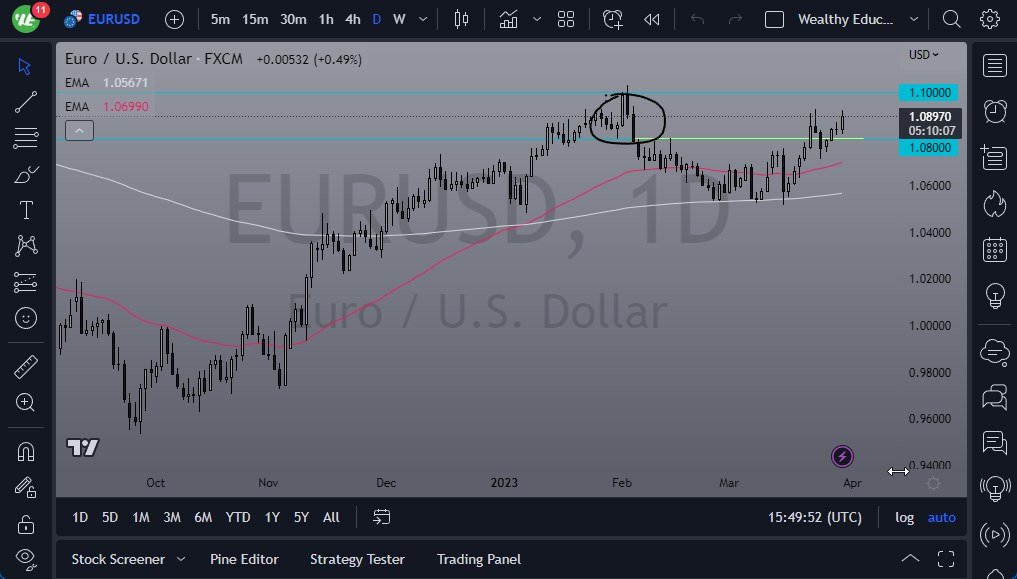

- The Euro (EUR) initially dipped against the US dollar (USD) during the Thursday trading session, but then turned around to rally significantly.

- The market has shown that there is still significant bullish pressure, but there is also a lot of resistance above, making it difficult to imagine a scenario where the market simply rips to the upside.

- The market will continue to be noisy as traders bet on the Federal Reserve bailing them out.

However, the Federal Reserve has remained steadfast in its desire to keep monetary policy tight, making it likely that the USD will eventually strengthen. The EUR/USD exchange rate has faced resistance multiple times in the past, making it susceptible to a potential drop with just a little push. If the market breaks down below the bottom of the candlestick from Thursday’s trading session, it is possible to drop down to the 1.07 level.

On the upside, the first challenge is to break above the shooting star from last week, opening up the 1.0950 level. However, there is a lot of noise near the 1.10 level, which causes a lot of issues in and of itself. Traders need to look for signs of exhaustion that they can fade, as seen last week. Whether or not that occurs remains to be seen, as the bond markets are volatile, but if interest rates in the US drop even further, it may change the narrative. However, if interest rates in the US rally again, the market is likely to drop down towards the 50-day EMA near the 1.07 level, potentially even lower than that.

The EUR/USD exchange rate has faced resistance multiple times in the past, making it susceptible to a potential drop. The Federal Reserve’s desire to keep monetary policy tight makes it likely that the USD will eventually strengthen. Traders need to look for signs of exhaustion that they can fade, as the market will continue to be noisy. If the market breaks down below the bottom of the candlestick from Thursday’s trading session, it is possible to drop down to the 1.07 level. Conversely, breaking above the shooting star from last week opens up the 1.0950 level, but there is a lot of noise near the 1.10 level that could cause issues. Because of this, expect a lot of noisy behavior.

Ready to trade our daily Forex analysis? We’ve made a list of the best regulated Forex brokers to trade Forex worth using.

[ad_2]