[ad_1]

A breakdown below Thursday’s candlestick could signal negativity, potentially sending the market to the ¥157.50 level—a region that offered substantial support based on the January trading activity.

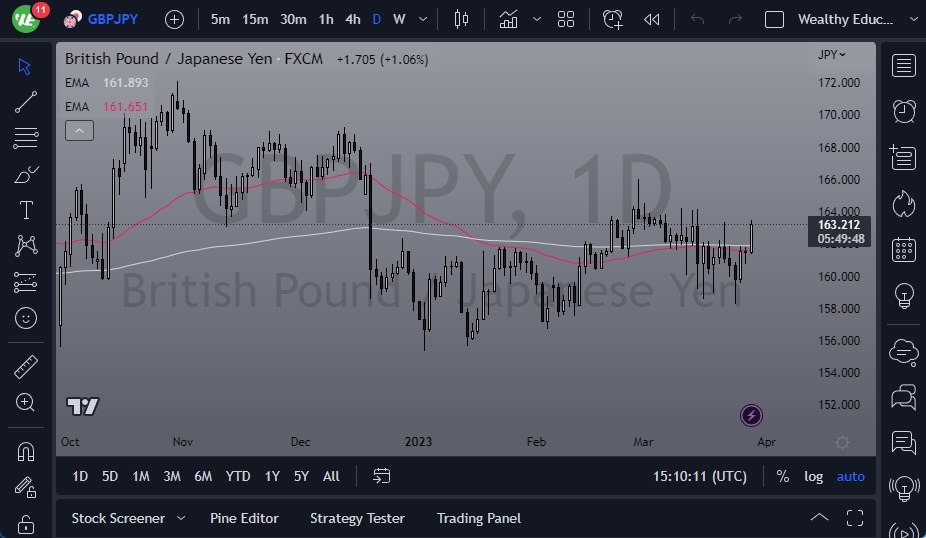

- The GBP/JPY experienced a sharp decline during Friday’s trading session, retreating from the 50-Day EMA and the 200-Day EMA indicators.

- As the currency approaches the psychologically significant ¥160 level, traders anticipate this area to attract attention, as buyers have consistently stepped in below this level over the past week.

- The markets underneath certainly see a lot of noise, but I think now it looks like we are simply trying to carve out some type of range.

The yen is a popular asset during turbulent times.

A breakdown below Thursday’s candlestick could signal negativity, potentially sending the market to the ¥157.50 level—a region that offered substantial support based on the January trading activity. Market participants view the GBP/JPY pair as a proxy for Japanese bond rates, with the Bank of Japan’s yield curve control policy dictating that the 10-year yield cannot exceed 50 basis points. If interest rates rise, the Bank of Japan would be compelled to intervene by printing yen to buy bonds and suppress rates. Conversely, falling rates allow the bank to let the market adjust naturally. This current phase suggests that the unwinding of short Japanese yen trades may continue.

The ¥162.50 level above represents a significant barrier; if the market were to break above this point, the British pound could test the ¥165 level. However, the current market conditions indicate that sellers may have a slight advantage. As choppiness is expected to continue, traders should exercise caution with position sizing and consider trading smaller amounts to mitigate risk. After all, the risk appetite in traders around the world seems to be a bit of a moving target now, and therefore caution is the better part of valor.

At the end of the day, the British pound has fallen against the Japanese yen amidst market volatility and concerns over interest rates. As the currency approaches the ¥160 level, the market may experience increased noise, indicating that the unwinding of short yen positions might persist. Key levels to watch include ¥157.50 as potential support and ¥162.50 as significant resistance. Traders should remain cautious with their position sizing, as market choppiness is likely to continue. Remember to pay close attention to the bond markets and what the 10-year JGB is doing, because that hard cap at the 50-basis points level will continue to be the major driver.

[ad_2]