[ad_1]

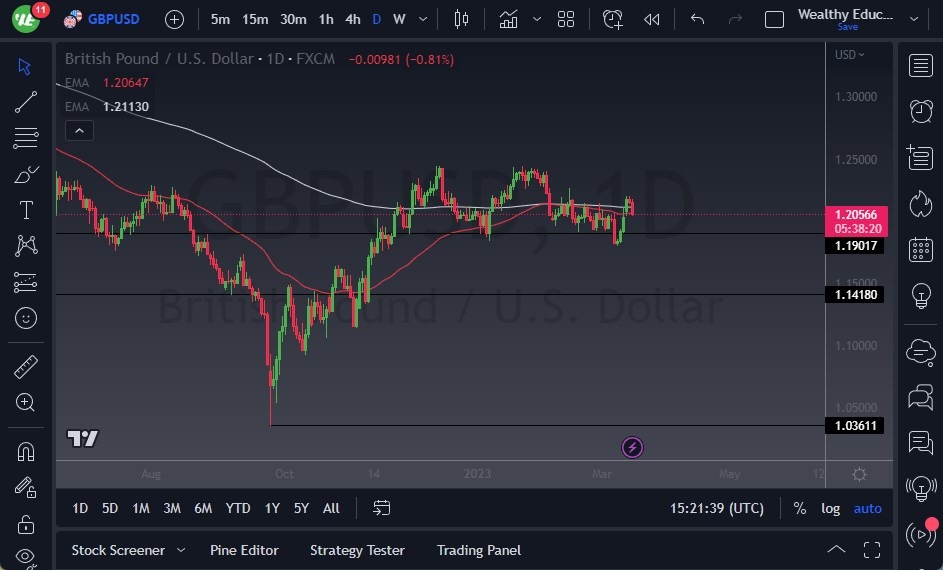

Should the market break down below the 1.20 level, the next support level to watch is the 1.1850 level, which corresponds to a recent swing low.

- The GBP/USD experienced a significant decline during Wednesday’s trading session, reflecting the increased risk aversion among investors worldwide.

- The market’s concerns were heightened by the news that Saudi investors will no longer bail out Credit Suisse, raising fears of contagion in the banking system.

- In response, market participants are likely to seek safety in assets such as the US dollar.

The 1.20 level is a critical area to monitor, as it represents a large, round, psychologically significant figure that many traders consider a potential support or resistance level. Market memory may also come into play at this level. Should the market break down below the 1.20 level, the next support level to watch is the 1.1850 level, which corresponds to a recent swing low.

A breakdown below the 1.1850 level could signal that the market is falling apart, opening the possibility of a decline to the 1.15 level. This level has been significant on multiple occasions in the past, and it is expected to be a source of considerable noise. The psychological impact of this level, coupled with the likely presence of options barriers in the vicinity, could lead to a turbulent market environment.

On the upside, if the market surpasses the highs of the Tuesday session, a move toward the 1.23 level becomes possible, followed by the 1.24 level. The latter level has recently formed a double top, indicating that significant selling pressure exists in the area extending to the 1.25 level. The 1.25 level has long been a crucial ceiling in the market, making it difficult for the British pound to break above it.

At the end of the day, the British pound has faced a sharp decline amid global risk aversion and concerns about potential contagion in the banking sector following the withdrawal of bailout support for Credit Suisse. Traders should pay close attention to key support and resistance levels, particularly the 1.20 and 1.1850 levels. If the market continues to weaken, a move toward the 1.15 level could be in the cards. On the other hand, a rebound would face resistance at the 1.23 and 1.24 levels, with the 1.25 level acting as a formidable barrier to any upward movement. Because of this, I remain a bit negative going forward as the situation seems to warrant it.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers in the UK to choose from.

[ad_2]