[ad_1]

If we can break above that 18.50 Rand level, then we could be looking at an attempt to get to the 20 Rand level.

- The US dollar has rallied during the trading session on Tuesday, as we continue to see it take off against most other currencies.

- The South African Rand is particularly sensitive at the moment, as it is considered to be a major “risk on” emerging market currency.

- As traders try to figure out where the global economy is going, that will have a major influence on South Africa, which of course has suffered quite drastically over the last couple of years with the pandemic.

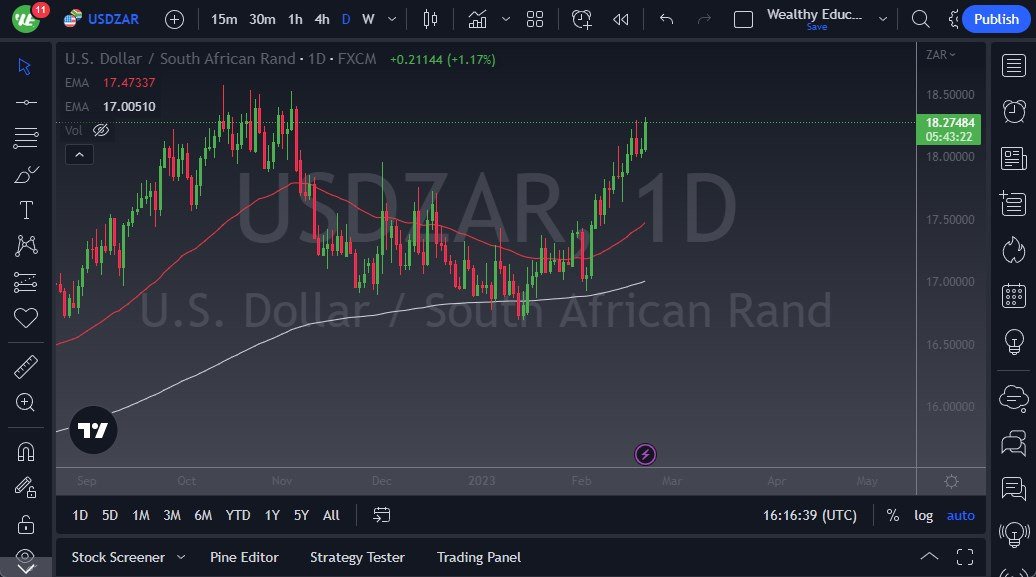

We currently are approaching 18.50 ZAR level, which is an area that has caused significant resistance in the past, going back to October. There was a lot of pushback at that point from the South African Rand, so it’ll be interesting to see if we can break through there. If we can, then that’s obviously a very bullish sign and would probably spell quite a bit of trouble for South African currency holders. However, we could be trying to form some type of larger consolidation region, which is not completely out of the question for an exotic currency pair like this. Underneath, we have quite a bit of support near the 16.75 Rand level, so that could be what we are looking at.

The 50-Day EMA sits at the 17.50 Rand level and is rising, with a 200-Day EMA sitting at the 17 Rand level. The next couple of session should be interesting, especially with Wednesday having the Federal Open Market Committee Meeting Minutes being released, and if it shows that the Fed is still extraordinarily hawkish, even behind closed doors, then that could send this market higher. Pay attention to commodities in general, because I can have an outsized effects on smaller commodity currencies such as the South African Rand.

You can make an argument that we have been a little bit overdone to the upside recently, but that does not necessarily mean that you should be a seller. If the US dollar starts to sell off against everything, then you might have an argument. Make sure to pay attention of the currency pairs, because it can give you a little bit of a “heads up” as to how this market may behave going forward. If we can break above that 18.50 Rand level, then we could be looking at an attempt to get to the 20 Rand level.

Ready to trade our daily Forex forecast? Check out how does forex trading work in South Africa here.

[ad_2]