[ad_1]

It looks as if the market is going to try to get to the ¥137.50 level, an area that has been important more than once.

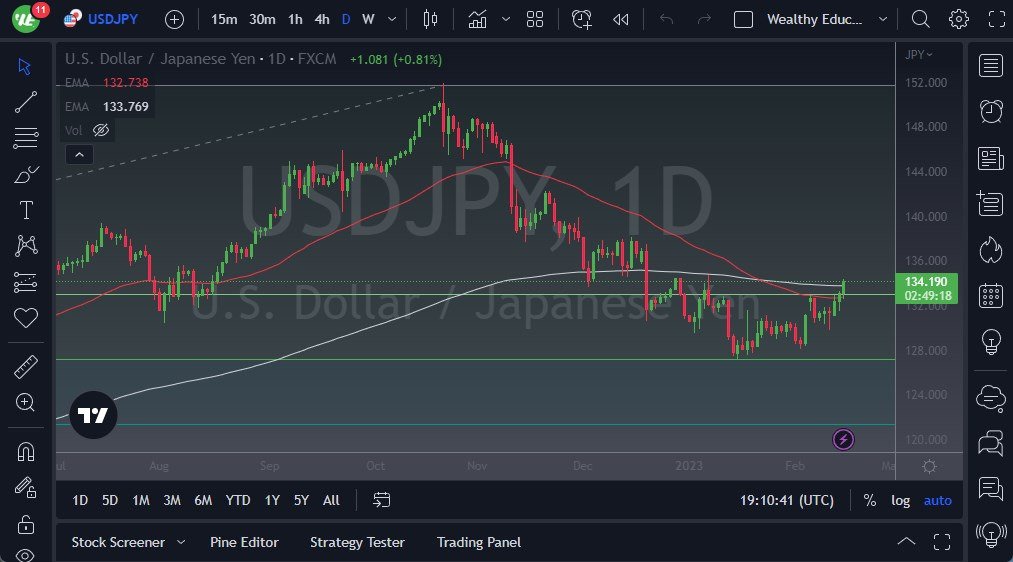

- The US dollar has rallied quite nicely against the Japanese yen during trading on Wednesday, as the market has now broken above the 200-Day EMA, which of course is a very bullish sign.

- By doing so, it looks as if the market is going to try to get to the ¥137.50 level, an area that has been important more than once.

- By breaking above there, then the market is likely to continue seeing a lot of upward momentum.

The yen is a popular asset during turbulent times.

Algorithms Could Kick In

Turning around and breaking below the bottom of the candlestick opens up the possibility of a move down to the ¥132 level, possibly even down to the ¥130 level. I think at this point we have to look at it through the prism of a market that is doing everything he can to find reasons to go higher, and of course the fact that the Bank of Japan continues to do yield curve control also suggests that it should continue to be that way. Looking at the overall chart, you can see that we have formed a huge rounding bottom, and now that we are above the 200-Day EMA, a lot of algorithms could kick in and have systematic traders joining the fray.

With the Bank of Japan having to keep yields low, it does make sense that every time they have to buy more bonds, and thereby printing more yen, that we should see this pair continue to climb. I do think that we will see a lot of volatility in general, but given enough time I also believe that this pair will probably try to get back to the ¥150 level, especially if interest rates and inflation numbers in the United States continue to be very strong, which of course they are. We had retail sales come out stronger than anticipated during the Wednesday session, which has its own effect on the bond markets.

If we do see bonds start to give less yield, then it’s possible that this pair pulls back, but I think the hammer from Friday of last week could be very supportive, so I would not be looking for the market to break down below there easily. If it did, that could change a lot of things but right now I just don’t see it happening any time soon.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.

[ad_2]