[ad_1]

You have to look at the overall risk appetite, because if it does start to pick up, that could send this pair much higher.

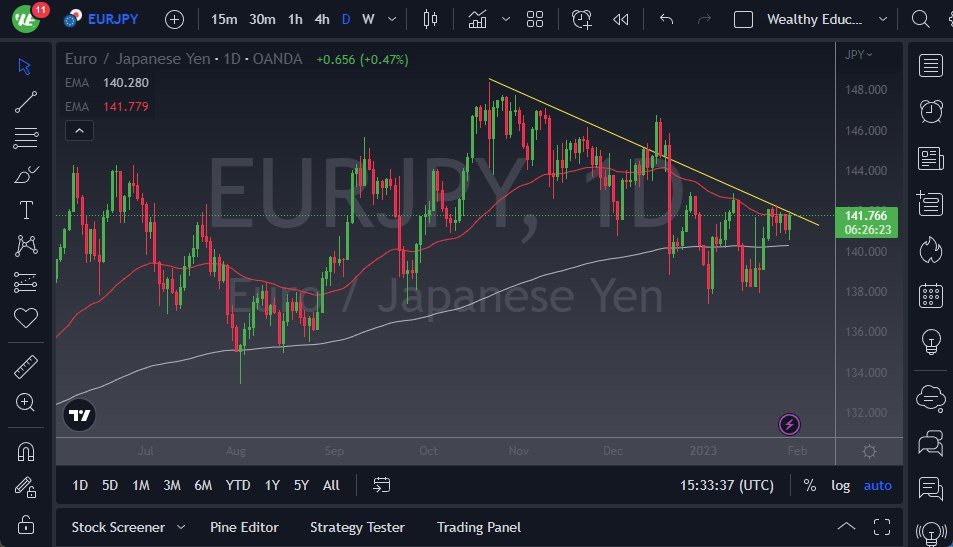

- The EUR/JPY currency pair pulled back just a bit during the training session on Monday, but then turned around to show signs of life as we had bounced from the 200-Day EMA.

- The 50-Day EMA is sitting at the resistance barrier that we are pressing up against, and then of course the downtrend line is right there as well.

- Because of this, the market is likely to see a lot of noise in this general vicinity, and then the ¥142.50 level could lead to a bigger move.

- If we can break above that, then it’s likely that we could go to the ¥145.50 level.

Bank of Japan Is the Biggest Factor in This Market

If we were to turn around and break down below the 200-Day EMA, then the market could go down to the ¥138.25 level. In this area, there is a lot of support, so if we were to break down below there, then we could see a drop rather hard below the ¥138 level. Anything below there would show the Japanese yen showing quite a bit of strength overall, but we also have to keep in mind that the Bank of Japan is by far the biggest factor in this market, as the Bank of Japan has determined that it needs to keep interest rates below 50 basis points on the 10 year note.

At this point, the market is likely to see a lot of pressure in this general vicinity, and therefore I think we are getting close to see some type of squeeze, as we are between the 50-Day EMA and the 200-Day EMA. With this being the case, the market is more likely than not going to continue to be under a lot of pressure, and I think we will see a huge amount of momentum in one direction or the other once we finally do make a decision. A lot of this is not only going to come from the Bank of Japan, but also the bond market in general. After that, you have to look at the overall risk appetite, because if it does start to pick up, that could send this pair much higher. On the other hand, if we see more of a “risk off” attitude around the world, that could send this pair back down to the 200-Day EMA, and then perhaps down to that ¥138.25 area. Regardless, I think it’s going to be noisy.

Ready to trade our daily Forex forecast? Here’s a list of some of the best currency trading platforms to check out.

[ad_2]