[ad_1]

Currently, if the pair goes up, it targets the resistance levels concentrated at 27.70 and 27.80, respectively, while if the pair declines, it targets the support levels concentrated at 27.30 and 26.99, respectively.

Forex Brokers We Recommend in Your Region

See full brokers list

Risk 0.50%.

- Entering a buy deal with a pending order from the 27.00 level.

- Place a stop loss closing point below the 26.75 level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 27.70.

- Entering a sell deal with a pending order from the 27.60 level.

- The best points to place a stop loss are closing the highest level of 27.75.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 26.90.

The price of the Turkish Lira varied against the US dollar during the opening of this week, as the pair stabilized near its highest levels ever. Investors followed the data issued by the Turkish Ministry of Finance, recording the country’s total external debt at about $475.7 billion, which represents about 46.5% of the GDP, while the net external debt recorded about $267.7 billion, which is equivalent to 26.2% of the GDP. Standard & Poor’s had fixed Turkey’s credit rating at B, while raising the outlook from negative to stable. Observers believe that this advancement in the rating is due to the shift in monetary policy in Turkey after a new economic team took over in the country after the presidential elections last June, during which interest rates recorded significant increases.

Meanwhile, the markets followed the news of the terrorist attack on the Turkish Ministry of the Interior, yesterday, Sunday, as terrorists carried out a bomb attack on the ministry’s headquarters in the Turkish capital. In this regard, Turkish President Recep Tayyip Erdogan said that the Turkish Armed Forces could begin another anti-terrorism operation around the country’s southern border areas, especially in Syria and Iraq. Turkey regularly carries out targeted cross-border operations in Iraq against the PKK, and continues to patrol the security zone in northern Syria with Moscow under an agreement signed in 2019. Experts do not expect the terrorist operation to have a significant impact on the economy or increase investor fears.

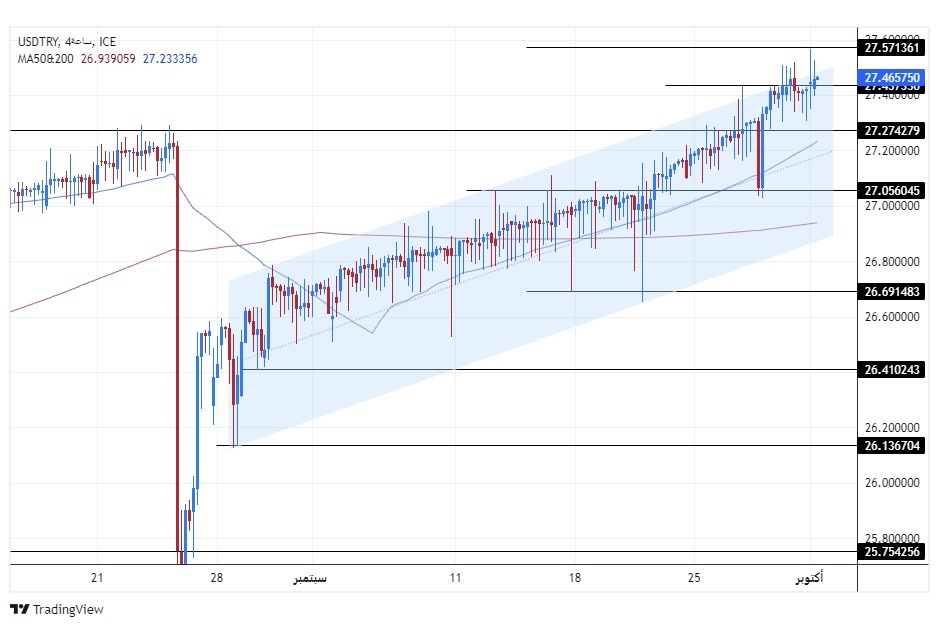

On the technical level, the dollar pair against the Turkish lira varied near its highest level ever, as the pair is currently trading at the upper border of the ascending price channel on the 240-minute time frame shown in the chart.

Currently, if the pair goes up, it targets the resistance levels concentrated at 27.70 and 27.80, respectively, while if the pair declines, it targets the support levels concentrated at 27.30 and 26.99, respectively. The price is moving above the 50 and 200 moving averages on the daily time frame, as well as on the four-hour and 60-minute time frames, indicating the buyers’ control and the return of the general upward trend recorded by the pair.

The pair is expected to record gains as long as it settles within the ascending price channel range. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

[ad_2]