[ad_1]

The nervous trading conditions have given the USD/SGD a rather solid base of support.

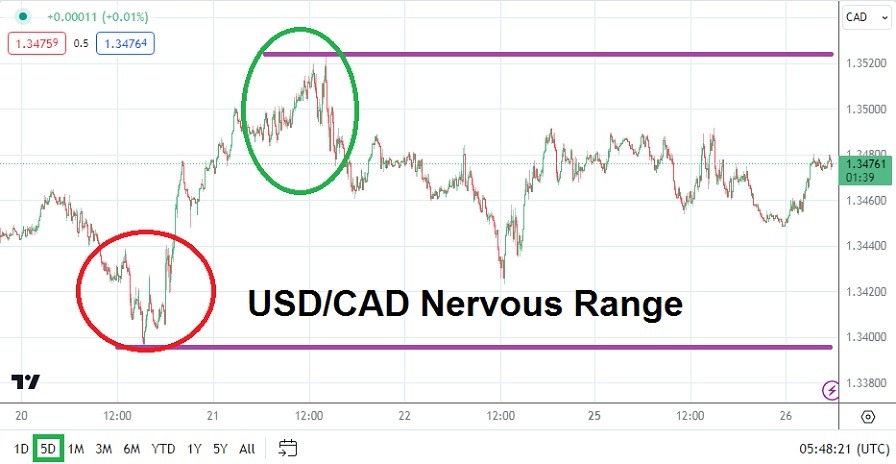

The USD/CAD has produced a rise in near-term values after testing lows last week, this as nervous market sentiment lingers and Forex remains challenging.

Forex Brokers We Recommend in Your Region

See full brokers list

The USD/CAD hit a low around the 1.33785 mark last Tuesday, and the low on Wednesday the 20th of September was near the 1.33950 value. Friday’s low was 1.34240 approximately and yesterday’s low for the USD/CAD was about 1.34460. The incremental gains of the USD/CAD upwards as technical support seems to be turning more durable is intriguing. The gains made in the near-term come after a rather solid amount of selling was seen in the USD/CAD starting around the 7th of September.

What seems to have happened is that the higher price of Crude Oil which helped the USD/CAD create a bearish motion for a week and a half of trading has now run directly into fragile market sentiment, causing the reversal upwards. The U.S Federal Reserve made it clear last week the Federal Funds Rate is likely to be increased sooner rather than later. Concerns regarding the higher price of energy have sparked renewed fears about inflation. The USD/CAD has mirrored the broad Forex market the past few days of trading as behavioral sentiment has turn sour.

The current price of the USD/CAD is near the 1.34800 ratio and upside price action has continued to be sparked early this morning. Traders should pay attention to the nervous U.S. equity markets as a barometer regarding the sentiment potentially being displayed by financial institutions. U.S. Treasury yields continue to attract plenty of investors, which is making U.S. stock markets fragile, but also making the USD stronger.

Resistance for the USD/CAD in the short term should be watched near the 1.34850 level. If this value is penetrated higher and prices are sustained above 1.34850 for a solid duration, this could be interpreted as a signal buying power in the USD/CAD remains firm.

The U.S. will publish the CB Consumer Sentiment data today and if this report shows stronger than anticipated numbers it would likely spur on a stronger USD. However, U.S. consumers may be starting to feel the ‘heat’ from higher interest rates as their credit card bills become more expensive, so today’s sentiment reading will be intriguing for investors and cause a reaction in Forex.

- On Thursday the U.S. will publish GDP numbers, and this will be followed on Friday by Canada’s GDP results.

- The contrast and potential of stronger U.S. growth figures, compared to the possibility of recessionary Canadian statistics could cause USD/CAD volatility.

- Short-term conditions are likely to remain cautious and if risk-adverse trading remains the main theme, the USD/CAD may produce more upside price action.

Current Resistance: 1.34850

Current Support: 1.34725

High Target: 1.35110

Low Target: 1.34570

Ready to trade our daily Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.

[ad_2]