[ad_1]

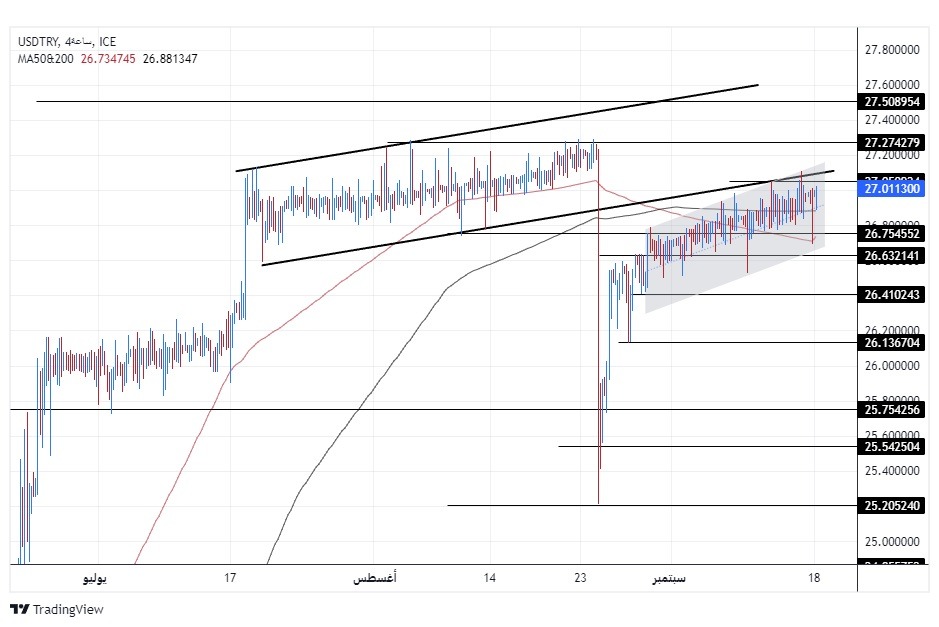

On the technical level, the USD/TRY recorded stability in a narrow range, although the pair maintained gains.

Forex Brokers We Recommend in Your Region

See full brokers list

Risk 0.50%.

- Entering a buy deal with a pending order from the 26.65 level.

- Place a stop loss closing point below the 26.15 level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 27.20.

- Entering a sell deal with a pending order from the 27.30 level.

- The best points to place a stop loss are closing the highest level of 27.65.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 26.70.

The USD/TRY maintained its slow movements with the opening of the market today, Monday, amid the successive measures of the Turkish Central Bank, which aim to tighten the monetary policy in the country. At the end of last week, the bank issued its decision to raise the cost of short-term deposits on commercial banks in the country, as the central bank aims to reduce lira deposits protected from fluctuations in the foreign exchange rate, known as (KKM), which is a deposit system introduced by Turkish President Recep Tayyip Erdogan at the end of the year. 2021 with the aim of controlling the declines of the lira at that time. The Central Bank of Turkey imposed on commercial banks to increase the amounts allocated as reserves for six-month accounts by 25 percent, compared to only 15 percent previously, while reducing the reserve allocated to accounts with maturities greater than six months to only 5 percent.

The decisions of the Turkish Central Bank come at a time when the markets are anticipating the interest rate decision next Thursday, as most expectations indicate that the central bank will maintain tightening monetary policy and raise interest rates during the next meeting, although the expected rate of increase varies, as most international banks indicate that the interest rate will be raised by 5 percent, bringing the main interest rate in the country to 30 percent, against contrary expectations issued by Barclays Bank to raise interest rates by only 2.5 percent.

On the technical level, the USD/TRY recorded stability in a narrow range, although the pair maintained gains. The pair continued its movement within the boundaries of the ascending price channel on the 60-minute time frame shown in the chart, within the general upward trend, as the pair retested the lower border of the larger ascending price channel on the four-hour time frame, which it broke earlier last month after the decision to raise interest rates.

Currently, if the pair goes up, it targets the resistance levels concentrated at 27.27 and 27.50, respectively, while if the pair declines, it targets the support levels concentrated at 26.50 and 26.13, respectively. The price moves around the 50, 100, and 200 moving averages on the daily time frame, and the pair also trades between these averages on the four-hour time frame, as well as on the 60-minute time frame, in reference to the divergence that the pair is recording in the short term.

The pair is expected to record some limited gains as long as it settles within the ascending price channel range. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.

[ad_2]