[ad_1]

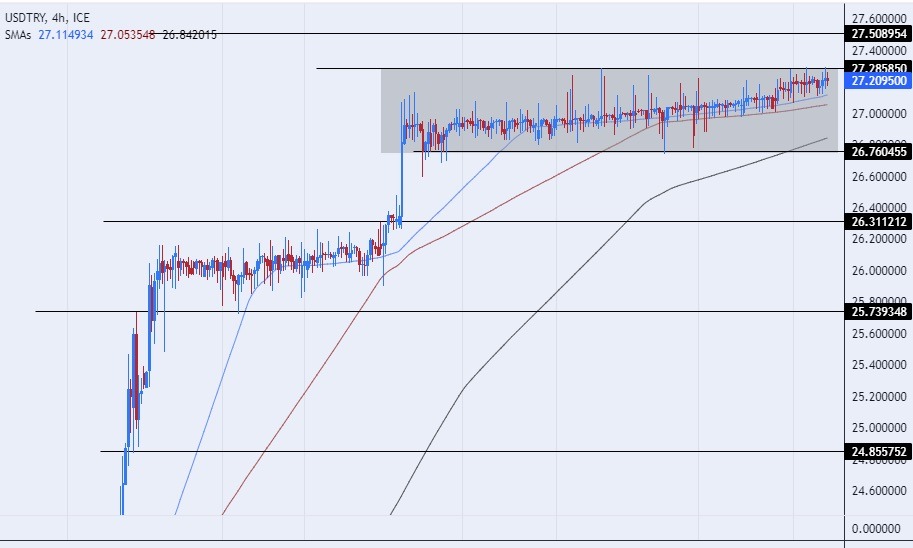

On the technical front, the dollar pair traded against the Turkish lira near its lowest levels ever during early trading Thursday morning, with the pair stabilizing around levels of 27.29 lira per dollar, as the dollar traded at its highest level against the lira in several weeks.

Forex Brokers We Recommend in Your Region

See full brokers list

The risk is 0.50%.

- Entering a buy order pending order from the 26.50 level.

- Place a stop loss point to close below the 26.25 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 27.50.

- Entering a sell order pending order from the 27.50 level.

- The best points to place a stop loss close to the highest level of 27.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 26.50.

The USD/TRY rose slightly, as the pair moved towards its highest levels ever. Data issued by the country’s Institute of Statistics revealed that the consumer confidence index in Turkey declined, reaching its lowest level since 2004, with the increase in the pressures of the restrictive monetary policy. Followed by the Central Bank of Turkey on household financial resources. The Consumer Confidence Index declined during the month of August, recording 68 points, compared to about 80 points recorded in July. The increases in prices, especially gasoline and some additional fees, as well as the increase in sales taxes, in conjunction with the interest rate hike, put negative pressure on the index. As for the index’s future expectations, the financial expectations of households and the economy over the next twelve months recorded record pressures.

Previous reports issued during the past week revealed that inflation expectations in Turkey had deteriorated with the decline in the performance of the lira. A survey conducted by the Central Bank of Turkey revealed analysts’ expectations of an increase in inflation at the fastest rate in about 20 years, and expectations showed that inflation rose during the next twelve months by about 9 points in August, which is the highest rate of increase since February 2002. This coincided with other expectations of an expansion of decline The lira is about 20 percent of its current value.

On the technical front, the dollar pair traded against the Turkish lira near its lowest levels ever during early trading Thursday morning, with the pair stabilizing around levels of 27.29 lira per dollar, as the dollar traded at its highest level against the lira in several weeks. If the pair rises, it will target the resistance levels that are concentrated at 27.50 and 28.00, respectively, while if the pair declines, it will target the support levels that are concentrated at 26.50 and 26.00, respectively.

The price is moving above the moving averages 50, 100, and 200 on the daily time frame, while the pair is trading between these averages on the four-hour time frame, as well as the 60-minute time frame, in a sign of divergence in the short term. The Turkish currency is expected to record some decline, especially if the pair breaks the upper border of the rectangle that the pair is trading inside. Please adhere to the figures in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

[ad_2]