[ad_1]

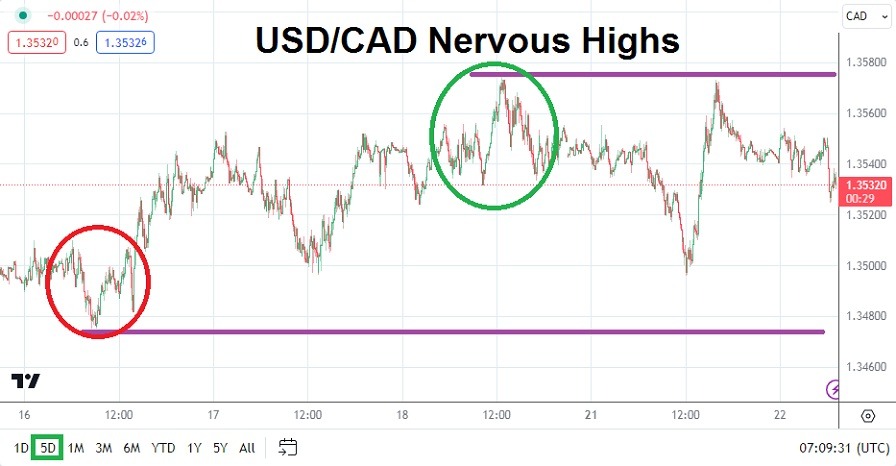

The USD/CAD on Monday came within sight of important higher values produced on Friday, however the upwards momentum halted and a reversal lower then took place.

Forex Brokers We Recommend in Your Region

See full brokers list

After failing to touch highs around the 1.35750 ratio that were traversed on Friday, yesterday’s trading having produced a high of nearly 1.35730 began to reverse lower. Before speculative bearish traders of the USD/CAD start a celebratory parade proclaiming a sustained reversal lower of the currency pair is about to develop, they should be careful and consider what has taken place the past the past five weeks of trading upwards.

Friday’s climb higher before going into the weekend pushed the USD/CAD to values not seen since the 1st of June. On early Monday, yesterday, the USD/CAD did reverse lower in a significant manner and broke below the 1.35000 level, actually testing the 1.34955 ratio which was a low seen on Thursday of last week.

However, after touching this short-term support level, the USD/CAD displayed a price velocity higher and came within sight of the highs traversed on Friday. This choppy trading demonstrates the rather delicate speculative ground the USD/CAD is navigating. The move lower since hitting yesterday’s higher values has brought the USD/CAD to about the 1.35320 ratios as of this writing as traders ponder what moves to make next.

- It is clear that behavioral sentiment in the broad markets remains nervous.

- The noise caused by financial institutions is loud and this has led to volatility and highs being tested in the USD/CAD.

- Economic data will be light today, except for U.S Existing Home Sales, and this result should not shake the USD/CAD too much.

- The Jackson Hole Symposium which will be held by the Federal Reserve later this week will be focused on traders, and global central bankers including the Bank of Canada will attend the event.

Current support near the 1.35300 to 1.35320 ratios should be watched. If these numbers are tested and values are sustained suddenly lower, this could signal that behavioral sentiment is starting to perhaps calm slightly. Less nervous trading conditions could help increase risk appetite which could spur on some USD/CAD selling in the short and near-term. Markets remain fragile and the upwards trend in the USD/CAD may look like it is overbought, but betting against the mid-term momentum is speculative. Traders looking for lower targets in the USD/CAD need to use very solid risk management.

Current Resistance: 1.35410

Current Support: 1.35275

High Target: 1.35550

Low Target: 1.35170

Ready to trade our Forex daily analysis and predictions? Here’s a list of the best Forex Trading platform Canada to choose from.

Ready to trade our Forex daily analysis and predictions? Here’s a list of the best Forex Trading platform Canada to choose from.

[ad_2]