[ad_1]

Entry price orders are essential if a trader wants to attempt to trade the USD/ARS.

Forex Brokers We Recommend in Your Region

See full brokers list

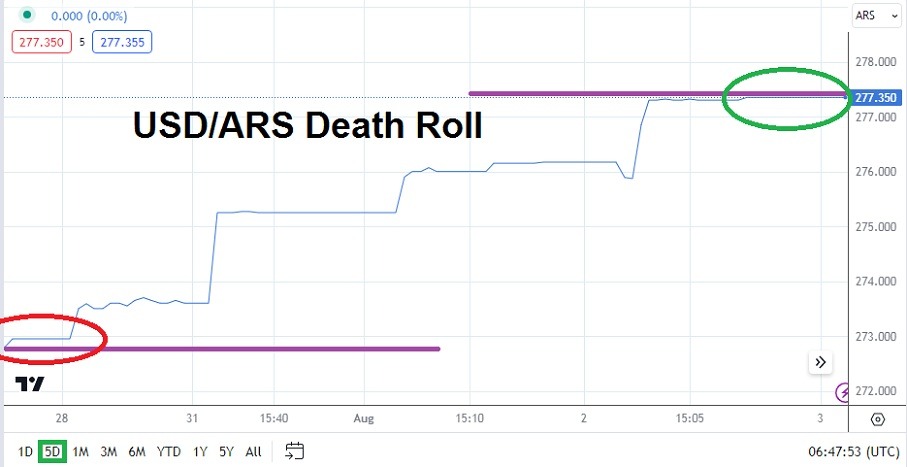

The ‘official’ exchange rate via the Argentina government as of this writing for the USD/ARS is close to the 277.350 ratio. The word official is highlighted because on Florida Avenue in the main shopping area of Buenos Aires the black market rate is much higher. The government of Argentina announced a restructuring of loan repayments recently with the International Monetary Fund, and this has not stopped the bullish trend of the USD/ARS upwards because no one believes the ‘ small bandage’ can fix a severely broken leg.

- The Economic Minister of Argentina, Sergio Massa, said early this week that Argentina will make a loan payment to the IMF this week with the help of a China ‘bridge loan’.

- Elections are coming this October in Argentina and the people of the nation have an important decision to make. However, there are doubts that a fiscally responsible government will be elected.

- Talk of a unified currency with Brazil has gained little traction, and financial institutions worldwide are skeptical of any promises from Argentina to get its economic house in order. Argentina remains alone in the wilderness fiscally.

- Corruption and a historical track record of broken economic reform pledges haunt Argentina.

Traders who are somehow allowed to still trade the USD/ARS on platforms should not do so blindly. There will be likely wide spreads via brokers, fees for initiating a ‘purchase’ of USD/ARS, and overnight carrying charges. The word purchase is highlighted because few in their right mind would actually attempt selling the USD/ARS unless they had inside knowledge the USD/ARS was about to momentarily enjoy a downturn. Yes, it is true slight reversals still occur, but attempting to short the USD/ARS is a bit like spitting in the wind. Entry price orders are essential if a trader wants to attempt to trade the USD/ARS.

Since late January of this year, the Argentine Peso has lost nearly 1/3 of its value. The currency pair transacts in a ‘fiscal state’ of its own, and financial institutions globally refuse to hold the Argentine Peso unless they absolutely have to (and few financial institutions need to do this – the world of Forex is not a game of favors being done to please anyone). Unless you are China which appears to have a political agenda with Argentina and is looking to influence the South American nation moving forward, most other nations including corporations try to find other ways to transact business.

Please do not get me wrong, Argentina is a beautiful country, which should have been one of the richest nations in the world. However, corruption is pervasive in Argentina and political rhetoric cannot hide the economic and fiscal flaws being suffered by the majority of its people. The USD/ARS bullish trend is likely to grow worse.

Current Resistance: 278.100

Current Support: 276.300

High Target: 279.300

Low Target: 276.000

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.

[ad_2]