[ad_1]

Pay close attention to the overall risk appetite because the US dollar is a safe currency, and the South African Rand is a “risk on the currency.”

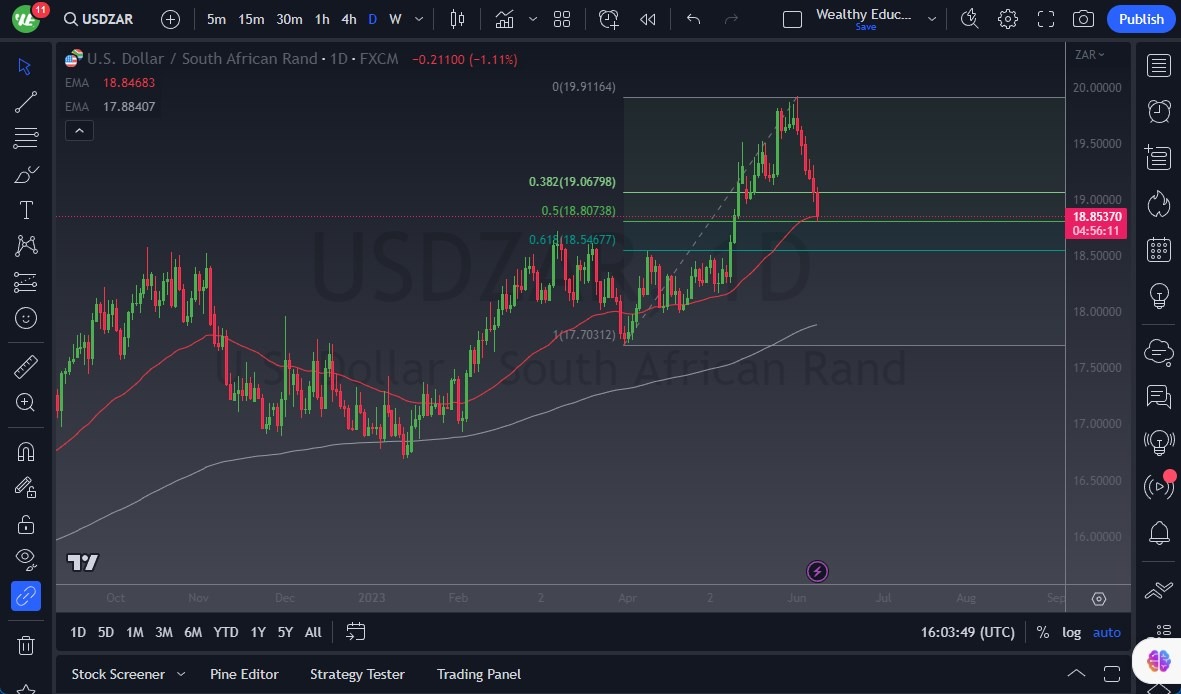

- The USD/ZAR has fallen rather significantly over the last couple of weeks against the South African Rand, for we are approaching several technical indicators underneath that could offer a significant amount of support.

- The 50-Day EMA is hanging around the 18.85 level, of course, we have the 50% Fibonacci level in the same area.

- It’ll be interesting to see if support comes back into the mix, but I certainly think that we are in an area where we start looking for it.

Forex Brokers We Recommend in Your Region

See full brokers list

Pay close attention to the overall risk appetite because the US dollar is a safe currency, and the South African Rand is a “risk on the currency.” Ultimately, this is a situation where we see a lot of noisy behavior, and therefore we think it’s likely going to continue to be one of those situations where we see a lot of indecision, and therefore it’s likely that we have to be very cautious with our position sizing. Ultimately, this is a situation where we will have to be very cautious, due to the fact that this pair is somewhat then, but the fact that we are at an area where a lot of value traders will be looking toward picking up “cheap dollars”, it’s probably worth the risk appetite. Ultimately, this is a situation where we see a lot of noise. If we break out above the top of the candlestick for the trading session on Thursday, then it’s likely that we could see the US dollar really start to take off, perhaps trying to reach the 20 Rand level.

If we were to break down below the 18.50 Rand level, then the market could drop down to the 18 Rand level, and then eventually the 200-Day EMA. The 200-Day EMA of course would be very important for determining the overall trend, but right now it looks like we are trying to turn things around and continue the overall uptrend. If we were to turn around a break above the 20 Rand level, then the market could go much higher, perhaps really starting to take off.

The only thing that I think you can take from this is the fact that the markets are going to be noisy, so with that being the case money management will be crucial. Position sizing is paramount for trading emerging markets, and that is going to be no different here. I do believe in buying on the diff, and I think we’re getting close to a point where a bounce is coming.

Ready to trade our daily Forex analysis? Here’s a list of the best forex trading platforms South Africa to choose from.

Ready to trade our daily Forex analysis? Here’s a list of the best forex trading platforms South Africa to choose from.

[ad_2]