[ad_1]

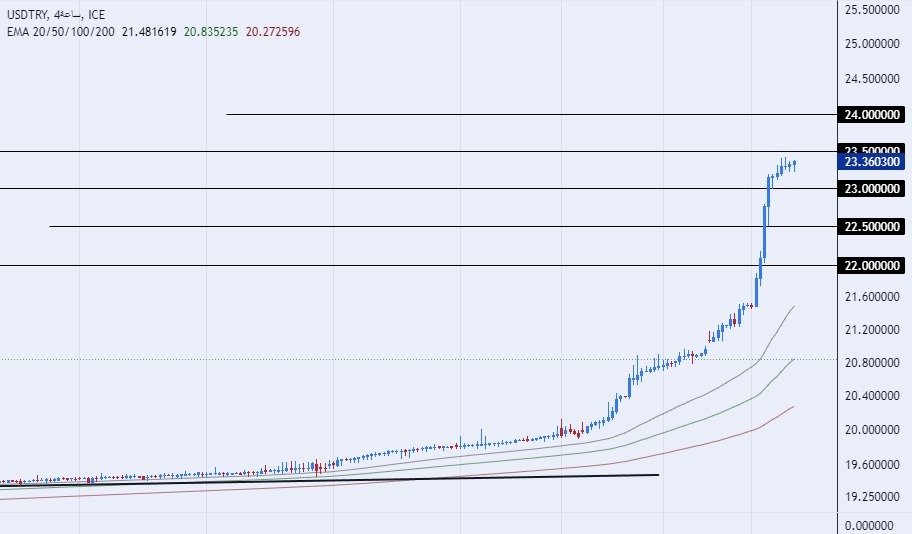

On the technical front, the dollar pair continued to rise against the Turkish lira within the pair’s trading in a strong general bullish trend that continued for about more than a month, with the pair recording new levels on a daily basis without any significant corrections.

Forex Brokers We Recommend in Your Region

See full brokers list

The risk is 0.50%.

- Entering a buy order pending order from the 23.20 level

- Place a stop loss point to close below the 23.00 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 23.50.

- Entering a sell order pending order from the 23.50 level.

- The best points for placing a stop loss close the highest level of 23.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 23.25.

The Turkish lira continued its losses against the US dollar over the course of the current week, as the Turkish currency recorded strong declines over the past two months. Amid political and monetary influences that include the Turkish elections and their results. Previously, the expectations of the reports of international financial institutions were that the lira would decline against the dollar, away from the identity of the president who won the elections for several reasons, the most important of which was the inability of the country’s central bank to support the lira continuously, especially with the decline in the volume of cash reserves from the bank’s foreign capital. Optimism about the appointment of Mehmet Chimchik as head of the country’s Finance Ministry has not yielded real results so far, despite Chimchik’s pursuit of a traditional economic policy contrary to the policy of Turkish President Recep Tayyip Erdogan.

In this regard, Bloomberg Agency published reports on the request of the new Turkish Finance Minister to the country’s central bank to stop supporting the lira and not to interfere in the markets by pumping foreign currencies. While other agencies quoted Simsek’s remarks, in which he affirmed his commitment to developing rules-based financial policies to increase predictability. He also said that there are no shortcuts that include quick solutions, you can rest assured that our experience, knowledge, and dedication will help us overcome potential obstacles.

On the technical front, the dollar pair continued to rise against the Turkish lira within the pair’s trading in a strong general bullish trend that continued for about more than a month, with the pair recording new levels on a daily basis without any significant corrections. The pound declined during early trading this morning, as the pair reached 23.35 levels.

At the same time, the pair is trading above the support levels that are concentrated at 23.10 and 23.00, respectively. The price also settles below the resistance levels that are concentrated at 23.50 and 24.00.

The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. Even announcing the expected changes in monetary policy, any fall in the dollar against the lira represents an opportunity to buy back again. Please adhere to the figures in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.

[ad_2]