[ad_1]

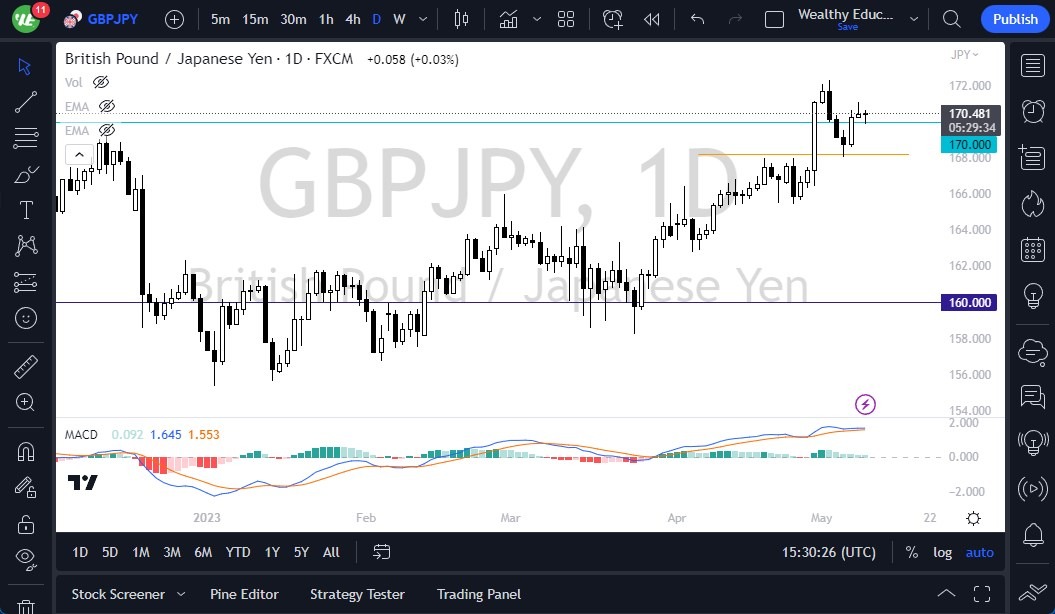

The British pound has shown resilience over the past few weeks, but it pulled back slightly during Tuesday’s trading session to test the ¥170 level.

- The British pound has shown resilience over the past few weeks, but it pulled back slightly during Tuesday’s trading session to test the ¥170 level.

- However, the ¥170 level remains an area to watch closely, as the market is likely to see choppy volatility with more of a push to the upside.

To the upside, the ¥171.20 level has seen resistance over the last day or so, but ultimately, the market is likely to continue trying to reach the ¥172.50 level. Any pullback at this point could provide a value proposition as traders look to pick up “cheap British pounds.” It is worth noting that the United Kingdom is currently experiencing high inflation, and an interest rate decision is coming soon, which could impact the market.

The Bank of Japan continues to choose a path of quantitative easing, with a limit of 50 basis points on their interest rates for the 10-year JGB. This means that there is a high possibility that the Bank of Japan will continue to inject Japanese yen into the market, as they have to print those yen to buy bonds to keep the interest rates low. In contrast, the Bank of England is likely to raise interest rates to deal with inflation, which puts momentum into the British pound. This creates a “perfect storm” for the pair to continue moving higher.

If the market breaks down from the ¥170 level, the 50-Day EMA sits right around the ¥166 level, which could define the trend. However, all things being equal, this is a situation where we see a “buy on the dip” market.

At the end of the day, the British pound remains resilient, with the market likely to continue seeing choppy volatility with more of a push to the upside. Traders should pay attention to the ¥170 level and look for potential opportunities to buy on the dip. The Bank of Japan’s quantitative easing and the Bank of England’s interest rate policy could impact the market, creating a “perfect storm” for the pair to continue moving higher. If the market breaks down, the 50-Day EMA at the ¥166 level could define the trend. Overall, traders should remain vigilant and monitor the market closely for potential opportunities and understand just how much of an influence that risks appetite can have on this pair at times.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.

[ad_2]