[ad_1]

It is important to keep a close eye on the market and the factors that are influencing it.

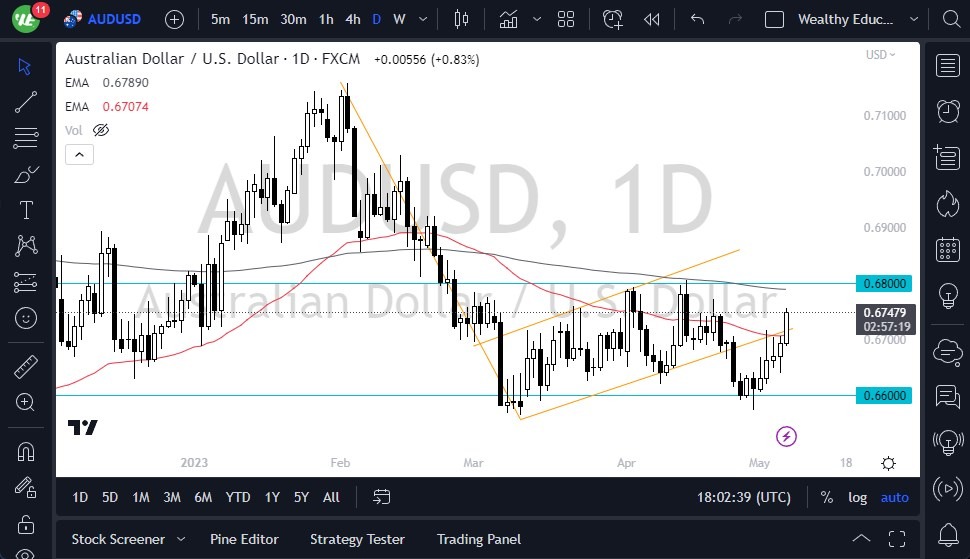

- The AUD/USD has experienced a bit of a rally in recent trading sessions, but this could be short-lived as the market continues to face downward pressure and volatility.

- This is not entirely surprising given the negativity surrounding the Australian economy over the longer term.

- The Reserve Bank of Australia’s recent surprise interest rate hike failed to have a lasting impact, and the market is now showing signs of fading.

Meanwhile, the US Federal Reserve is maintaining a tight stance to combat inflation, which could eventually lead to a slowing down of the economy. However, the latest jobs report indicates that employment remains strong, suggesting that demand may not drop. Despite this, the Australian dollar still has to contend with the 200-Day EMA above, which is currently near the 0.68 level.

It is clear that the Australian dollar is highly sensitive to economic pressures and global growth, and there are many concerns around the world when it comes to the economy. This means that investors need to exercise caution when making decisions about getting aggressive with the currency. In fact, signs of exhaustion will continue to be a major issue, and the noise surrounding the market is not helping matters. In fact, it seems to be getting worse.

That being said, there are some positive signs that could help bolster the Australian economy. For example, China is starting to show signs of strengthening, which could increase demand for Australian metals. This could ultimately lead to a better understanding of where the market is headed in the long term, but for now, it seems like the market is swimming upstream.

It is important to keep a close eye on the market and the factors that are influencing it. While there may be some short-term gains, investors need to be aware that the market could turn downward at any moment. The Australian dollar is still facing a lot of uncertainty, and the global economic situation is not making things any easier. For now, it is best to exercise caution and wait for more clarity before making any major moves in this market. In this environment, it is a short-term market at best. I favor a rangebound strategy, with an eye on the downside until we clear 0.68 on a daily close.

Ready to trade our daily Forex forecast? Here’s some of the top forex online trading Australia to check out.

[ad_2]