[ad_1]

If the market breaks above the $2050 level, it could open a new rush of buying pressure, with the gold market likely to head toward the $2100 level.

- In Wednesday’s trading session, the gold markets initially pulled back but showed a significant amount of resiliency, with buyers continuing to flock to the asset.

- Traders are concerned about wealth preservation and are turning to gold as a safer asset.

- With this trend expected to continue, gold is likely to be one of the better-performing assets.

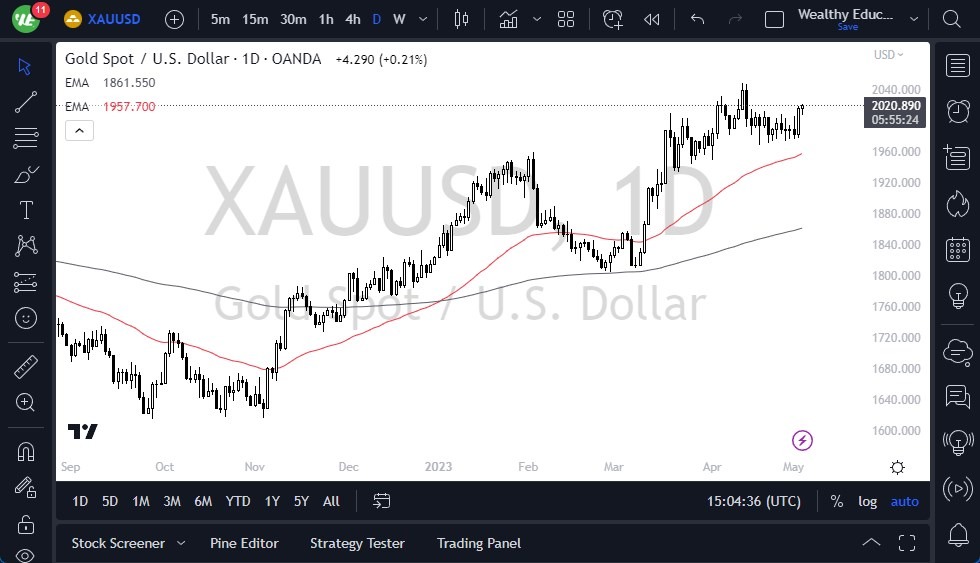

If the market breaks above the $2050 level, it could open a new rush of buying pressure, with the gold market likely to head toward the $2100 level. This will open the possibility of a more “buy-and-hold” type of market, which is essentially what the gold market is already in if traders got into their positions early enough. Despite being a very noisy market, it is currently very difficult to short gold in this environment.

The 50-Day EMA sits near the $1975 level and is rising, offering potential technical support for the overall trend. This level is likely to continue to offer important support, and traders should pay close attention to the market if it gets anywhere near this level. If it does, I suspect that there should be plenty of value hunters entering the market.

With the Federal Reserve announcement and the European Central Bank announcement taking place on Thursday, the gold market is expected to be very noisy and erratic. Furthermore, the upcoming jobs report on Friday could lead to a messy couple of days for traders. In this environment, traders should not ignore the overall trend and should not let short-term erratic moves shake them out of positions by over-leveraging them.

At the end of the day, the gold market is showing resilience in the face of uncertainty, with traders turning to it as a safer asset. The market is likely to continue to be volatile, especially around the central bank announcements and the upcoming jobs report. The 50-Day EMA is offering potential technical support for the overall trend, and traders should be cautious with their position sizing. Despite the market is noisy, it is difficult to short gold in this environment, and traders should not let short-term erratic moves shake them out of positions by over-leveraging them. Overall, the trend is expected to continue, and traders should be patient and stay invested for the long term.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold brokers worth trading with.

[ad_2]