[ad_1]

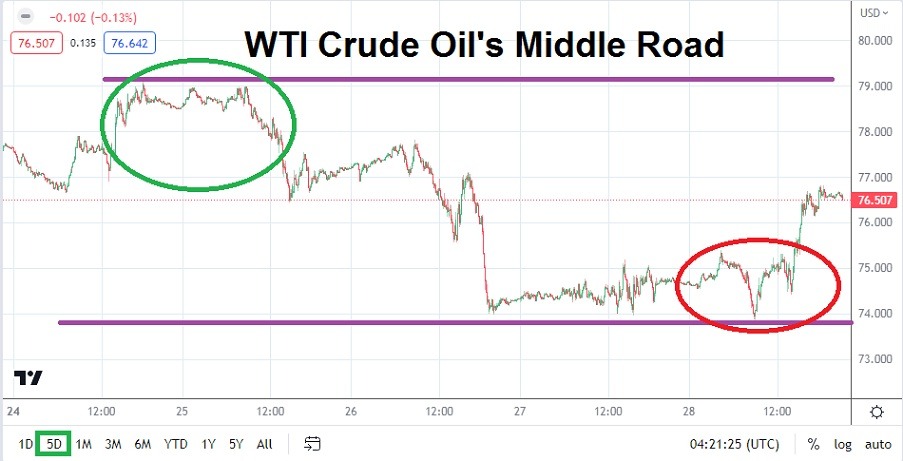

WTI Crude Oil finished the week’s trading within the middle of its five-day price range, but also experienced the week’s lowest value just hours beforehand.

WTI Crude Oil went into the weekend near the 76.507 price having finished a seemingly speculative week with a slight flourish higher. However, WTI Crude Oil also finished the week’s trading in the middle of its one-week results, after touching its lows for the week only a handful of hours before Friday’s session came to an end. WTI Crude Oil for the moment appears to have found a rather solid speculative equilibrium and one that is being wagered on by its market participants.

WTI Crude Oil also finished Friday’s trading slightly lower than its lowest depths at the start of the week on Monday the 24th of April when the commodity touched the 76.696 mark momentarily, this before achieving its high for the week on Tuesday at a price of nearly 79.075 USD. Since reaching highs which tested the 83.000 mark in the middle of April, WTI Crude Oil has incrementally lowered in value.

Although WTI Crude Oil recovered some price value on Friday and finished the week within the middle of its price range, the commodity also suffered hints of stronger selling. A price of nearly 73.870 was seen on Friday, which was slightly below Wednesday and Thursday’s lows around the 74.000 mark. And even though the reversal higher in WTI occurred, speculatively the commodity is still fairly close to its lows for the month of April. Thus the middle-of-the-road perception that some technical traders may have is also legitimately roaming near important depths.

- Support in WTI Crude Oil should be watched and the 74.000 price may be important, if this value is not sustained this week the commodity could test values seen in the last week of March.

- The price of Crude Oil jumped at the start of April as speculators reacted to concerns regarding production cuts from Saudi Arabia. However, those concerns seem to have faded.

- The fear of recession and the actual knock-on effect from the prospect of limited manufacturing may cause a drop in demand of Crude Oil, which may create sentiment that favors less buying of WTI.

The trading results of WTI Crude Oil leave an open field for speculators to gather their perceptions about direction. While the commodity seems to be hugging the middle of its price range, it is also showing a potentially bearish trend. If traders remain worried about less demand for Crude Oil because large manufacturing sectors are not in a rush to buy, WTI could find itself under more price pressure. However, the potential exist that consideration that summer is approaching and more Crude Oil will be needed for people driving while on vacations may create some support. However, summer still may be too far away and demand may remain restrained.

The speculative price range for WTI Crude Oil is 71.800 to 79.300 USD.

Support near the 75.000 to 74.000 USD ratios should be watched, if the price of WTI Crude Oil falls below the 74.000 mark and is sustained this could create additional price pressure and a test of the 73.000 ratio. Last week’s finish did provide a higher reversal going into the weekend, but the fact that the commodity tested lows on Friday too, should serve as a warning that the price of WTI Crude Oil may be vulnerable to more selling. Speculators cannot be blamed for having a bearish short-term perspective of WTI and may want to consider wagering on lower values after slight moves higher.

Resistance above received its biggest test in WTI Crude Oil early last week when the 79.000 value was challenged on Tuesday. However, after this brief test of highs, incrementally the commodity began to ebb lower. For Crude Oil to jump higher it would help bullish traders if the ISM Manufacturing PMI report from the U.S. on Monday came in better than expected. If that doesn’t happen WTI Crude Oil may have to wait until the end of the week to see renewed faith for the potential of increased demand, this via jobs numbers on Friday from the States.

[ad_2]