[ad_1]

This is a market that will continue to be noisy, so traders need to be flexible and keep their position size reasonable.

- The GBP/JPY experienced some dips in Thursday’s trading session, but buyers soon entered the market, turning the situation around.

- The Bank of Japan has continued to see the need to keep interest rates down, printing yen and buying bonds whenever they begin to rise.

- Meanwhile, the British pound has been one of the better performers worldwide, indicating a potentially bullish market.

The yen is a popular asset during turbulent times.

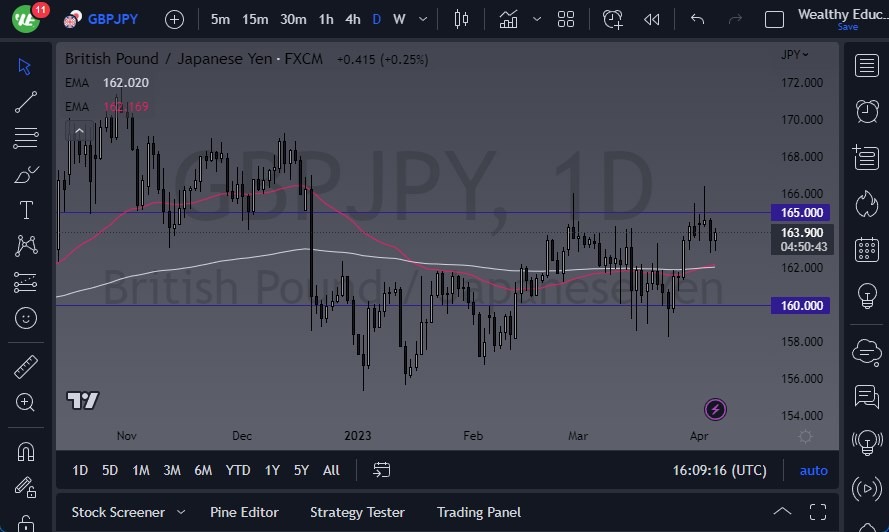

However, traders should keep an eye on the ¥165.50 level, which has previously experienced significant selling pressure, resulting in the formation of a shooting star several weeks back. This means that the area is likely to be challenging to navigate. If the market breaks above this level, it could result in a potential move to the ¥169 level. On the other hand, if the market breaks down below the bottom of the candlesticks for the last few days, traders will need to watch the 50-Day EMA and 200-Day EMA indicators sitting just below.

It’s worth noting that the area below the EMAs could attract a lot of attention, with traders aiming for the ¥160 level. This is a market that will continue to be noisy, so traders need to be flexible and keep their position size reasonable. The yields in Japan will also need to be watched closely as they have the potential to cause significant volatility in the market, not just for the British pound but for all other yen-related pairs going forward. Currently, the yield curve control game is the biggest game in town.

Despite the potential challenges, there are still opportunities for traders in this market. Traders should stay up to date with the latest developments and remain flexible in their approach. It’s also crucial to maintain reasonable position sizes and watch the key indicators, such as the EMAs, to help navigate the market’s volatility.

TLDR; the British pound has seen some dips in Thursday’s trading session, but the Bank of Japan’s continued efforts to keep interest rates down and the pound’s overall performance suggest a potentially bullish market. However, traders should keep a close eye on the challenging ¥165.50 level and watch for potential moves to the ¥169 or ¥160 levels. Ultimately, traders should stay flexible, keep their position sizes reasonable, and monitor key indicators to navigate the market’s volatility.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]