[ad_1]

The Turkish currency maintained its stability despite the stimulus policy pursued by the country’s central bank, with the support of the country’s president, who effectively dominates the monetary policy committee at the central bank.

The risk is 0.50%.

- Entering a buy order pending order from the 19.00 level.

- Place a stop loss point to close below the 18.85 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the strong resistance levels at 19.50.

- Entering a sell order pending order from the 19.50 level.

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05.

The price of the TRY/USD declined against the US dollar during early trading this morning, as the dollar pair against the lira recorded new highs. Despite the pressures on the US dollar against major currencies due to signs of declining inflation in the US and the approaching peak of interest rate hikes in the US, the lira did not benefit from these declines, as political and economic pressures accumulate. A number of reports revealed the central bank’s inability to support the lira strongly, as happened most of the past year, especially in the last quarter of the year, when the price of the lira recorded stability against the dollar despite the discrepancy in monetary policy between the US Federal Reserve and the Central Bank of Turkey.

The Turkish currency maintained its stability despite the stimulus policy pursued by the country’s central bank, with the support of the country’s president, who effectively dominates the monetary policy committee at the central bank. However, the succession of events that caused a decline in the volume of foreign exchange reserves over the past two months determined the ability of the Turkish Central Bank to support the lira. The lira topped the list of the worst-performing currencies in emerging markets during 2022, despite the support, as it lost about 30% of its value and lost about 15% during the first quarter of this year.

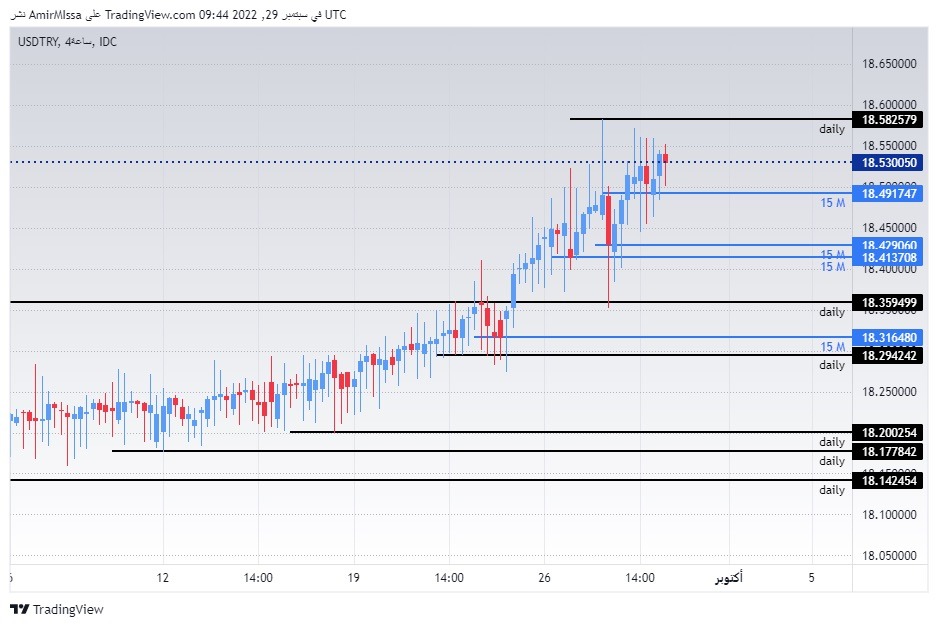

On the technical front, the USD/TRY rose lira slightly during the day’s early trading, as the pair recorded new highs, recording 19.24 liras per dollar. The report was written. The pair had previously retested the levels of the upper boundary of the bullish price channel on the time frame of the day, which it breached during Last week’s trading, the dollar maintained its rise against the lira at a slow pace, with the pair trading above the support levels 19.11, 19.06, and 19.00, respectively.

On the other hand, the price is settling below the psychological resistance levels at the integer 19.50 and 20.00 levels, respectively. The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. Because of the divergence in monetary policy and the economic position of Turkey, and fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]