[ad_1]

In general, this is a market that I think continues to see a lot of volatility going forward but given enough time I also think that we have a scenario where the volatility is going to continue to be monitored.

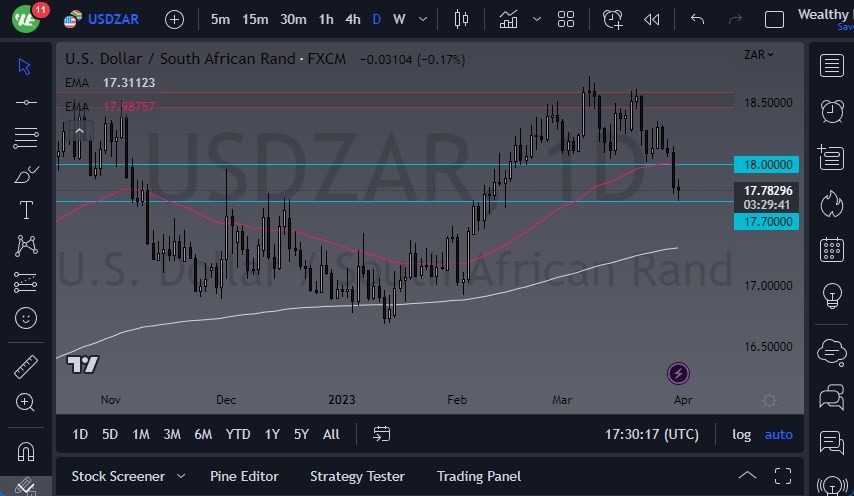

- The USD/ZAR has gone back and forth during the trading session on Friday, as it looks like the 17.70 whether those starting off for a little bit of support, as well as previous resistance.

- Furthermore, when you look at the chart you can see that we are between the 50-Day EMA and the 200-Day EMA indicators, so it does look as if we are going to see some type of volatility which is typical in that scenario.

- Furthermore, if we start to see some type of problem with risk appetite, that will be more likely than not see the US dollar strengthened, especially against emerging market currencies like the South African Rand.

On a break above the 18 Rand level, it’s likely that the market could go looking to the 18.50 Rand level, which was a recent double top. That of course is a strong selling pressure area, but if we can break above there then I think the South African Rand could go looking to the 20 Rand level. On the other hand, if we break down below the 17.70 Rand level, the 200-Day EMA would be the target. That is currently hanging around the 17.50 Rand level, which is also in the middle of the consolidation area that we had bounced from.

In general, this is a market that I think continues to see a lot of volatility going forward but given enough time I also think that we have a scenario where the volatility is going to continue to be monitored, therefore if the stock markets take a bit of a hit, or commodity markets take a bit of a hit, then it’s likely that the South African Rand will as well. After all, the South African Rand is a commodity currency, and therefore it has the same attachments as other currencies like the Canadian dollar, Norwegian chronic, New Zealand dollar, etc.

Furthermore, interest rates in America rallying will also help this pair, so pay close attention to that as well. All things being equal, risk-off will have traders going higher in this pair, just as the market will be going lower if risk appetite continues to return. The candlestick for the Friday session does suggest that perhaps we have a little bit of hesitation in the market, so that could lead to a turnaround.

[ad_2]