[ad_1]

The EUR/USD has been all over the place during the previous week, as we try to figure out where we’re going next. Ultimately, this is a situation where the markets will probably have to wait until after the Federal Reserve announcement on Wednesday. With that being said, I expect a lot all back and forth sideways action for the first couple days of the week, followed by an impulsive move in one direction or the other. If we can break down below the bottom of the weekly candlestick, we could see a move down to the 1.03 level. On the upside, the 1.08 level could be a major barrier as well.

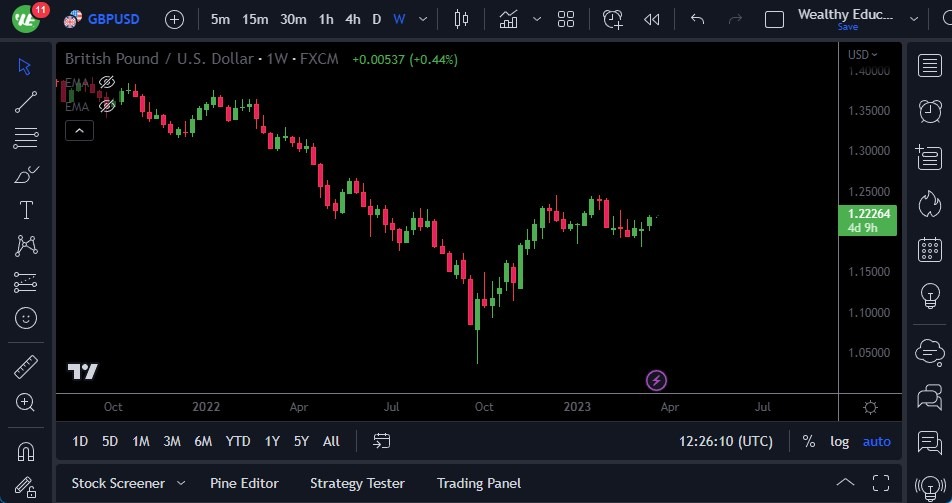

The GBP/USD has had a slightly positive week against the US dollar, but it looks as if it is still trading in the same range it has been in for a while. Because of this, expect the 1.20 level underneath to offer support while the 1.24 level above offers significant resistance. We could see an impulsive candlestick by the end of the week if the Federal Reserve does shock the market somehow, so be advised that most of the momentum for the week will probably happen on late Wednesday, followed by Thursday and Friday. The first couple of days could be very choppy.

The AUD/USD has had a positive week but continues to see a lot of noise just above current trading. At this point, the 0.67 level is an area that still has to be watched closely, and like with most other pairs around the world, they are probably going to be waiting for the Federal Reserve announcement to decide what to do with it next. The massive candlestick from the previous week does suggest that there is more downward pressure, but expect more range bound for Monday and Tuesday than anything else.

Gold markets have seen an explosive week, and as a result, we could see even further gains during the next one. Typically, big moves like this don’t happen in a vacuum, so one would have to think that there will be plenty of “buy on the dips” types of traders out there looking to get involved. To the downside, there are multiple support levels on various time frames that could be leaned on, with a particularly large amount of support near the $1950 level.

The S&P 500 had a positive week but still struggles with the idea of getting above the 4000 level. Ultimately, I think this is a market that will continue to see more noise than anything else, especially as we have to worry about a lot of noise coming out of the Federal Reserve meeting on Wednesday. Furthermore, whether or not global growth is going to get stymied remains a question, so a lot of traders will be paying close attention to that 4000 level as it could attract a lot of psychological buying or selling.

The USD/CAD did fall during the previous week, but as the Bank of Canada has essentially stated that it’s done raising interest rates, the US dollar could very well overwhelm the Loonie this week if the Federal Reserve remains hawkish. The 1.38 level seems to be a significant barrier that a lot of people were paying attention to, so be advised that if we do break above that level, we could really start to take off. In the meantime, it looks like there are plenty of buyers out there that are willing to step in and pick up the US dollar, especially near the 1.37 level.

The USD/CHF has had a wild week, as we continue to see a lot of questions asked about the Federal Reserve and what its next move is. Ultimately, I think this is a situation where we are trying to build up some type of base, so to be interesting to see how this plays out. The 0.90 level obviously is a large, round, psychologically significant people that a lot of people will pay close attention to, and therefore should be thought of as a major indicator as to where the market goes next.

Above, I see the 0.95 level as a major resistance barrier, so we can get above there, that would obviously be a very bullish sign for the US dollar, probably something that you would see across the board against multiple currencies, not just the Swiss franc.

The EUR/JPY had a horrific week against the Japanese yen as we have seen interest rates jump all over the place. As long as that continues to be the case, you can make a strong argument for this market to continue seeing a lot of volatility, and perhaps negativity if interest rates continue to drop as the Bank of Japan continues its yield curve control. As things stand right now, it looks like ¥138 underneath is major support, while the ¥145 level above is major resistance.

[ad_2]