[ad_1]

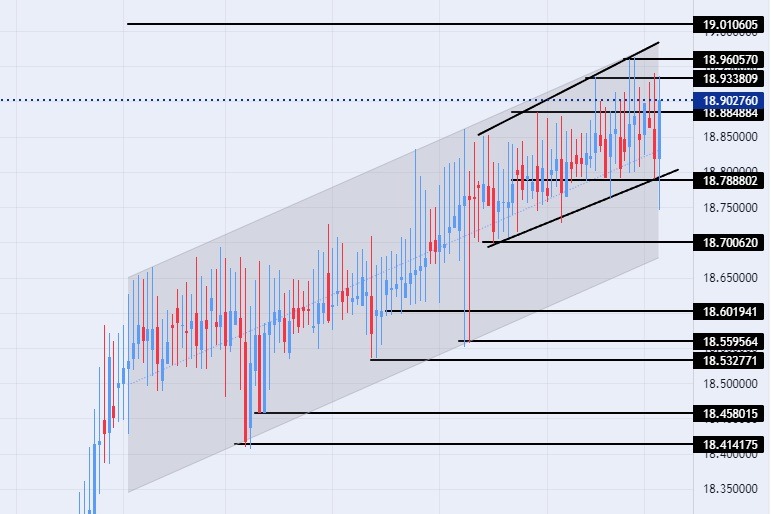

The pair is also trading below the resistance level at 18.96, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance level at 19.00.

The risk is 0.50%.

- Entering a buy order pending order from the 18.80 levels.

- Place a stop loss point to close below the support level of 18.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75.

The TRY/USD stabilized during early trading on Thursday morning. Investors followed recent data issued last Friday, which revealed a slight decline in inflation in the country during the month of February, despite the devastating earthquake that killed about 45,000 people in the south of the country. According to official data issued at the end of last week by the Turkish Statistical Institute, the country’s inflation rate declined on an annual basis, less than expectations during February, to record 55.18%, while the index rose on a monthly basis by 3.15%.

During the end of last year, the country suffered from record levels of inflation, as it recorded 85% in November before it recorded declines during the following months. Reports had expected an increase in government spending during the next few months, especially ahead of the presidential and parliamentary elections scheduled for May 14, despite the high inflation in the country as the Turkish president is working to pass the election period. Economists do not expect inflation to continue to decline significantly even if the Turkish president succeeds in the elections, given the monetary stimulus policies pursued by the Turkish Central Bank, which is under the effective control of Recep Tayyip Erdogan.

On the technical level, without major changes, the trading of the USD/TRY stabilized during the trading at the beginning of the week. The pair is moving in a generally upward direction after the lira recorded record levels of decline against the dollar at the end of last month after it touched 18.96 levels. At the same time, the pair continues to trade within the bullish channel on the daily time frame, and the pair is trading inside a smaller channel on the four-hour time frame. With the pair continuing its upward movement at a slow pace, the USD/TRY is trading above the support levels of 18.79, 18.70, and 18.63, respectively.

The pair is also trading below the resistance level at 18.96, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance level at 19.00. The USD/TRY is trading above the moving averages 50, 100, and 200 on the daily time frame, in a sign of the general bullish trend on the large time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the slow movement of the pair. Any fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]