[ad_1]

The market has turned around, showing signs of life in the greenback, and we have even formed a double bottom near the 50% Fibonacci level, near the ¥127.50 level.

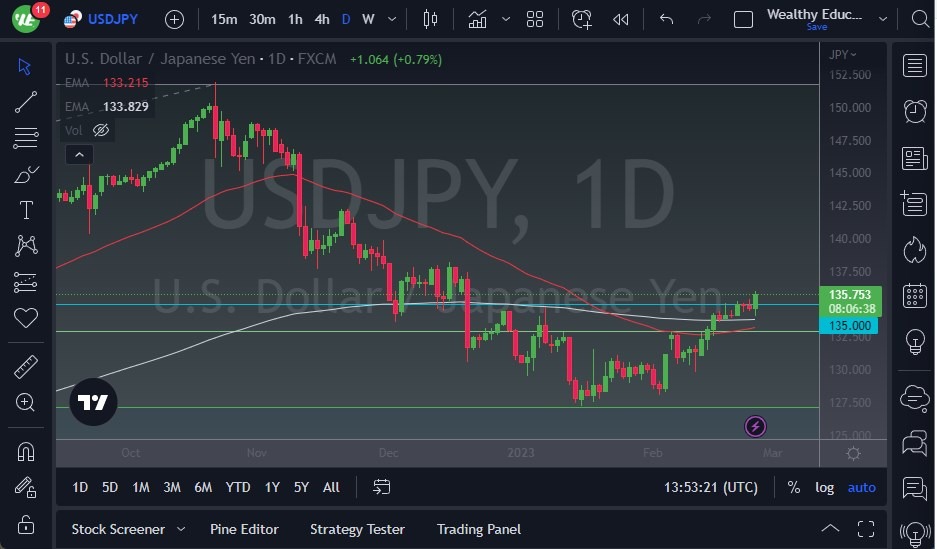

The USD/JPY made an interesting move during Friday’s session, as it was sold down to the 200-Day EMA, only to bounce back up again. Now that the market has climbed back above the ¥135 level, it appears that the US dollar may continue to strengthen against the yen in the coming weeks.

The yen is a popular asset during turbulent times.

One reason for this could be the Bank of Japan’s desire to keep the 10-year yield down to 50 basis points. In order to do this, they will have to print Japanese yen to buy the bonds. With the bond market showing signs of a potential breakout, the Japanese are expected to print more yen aggressively, which could further weaken the currency.

Given these factors, there is a good chance that the US dollar could go much higher against the yen in the coming days. The ¥137.50 level is a key resistance barrier but given the momentum, we are seeing in the market; it is likely that the US dollar will try to test this area soon. The candlestick chart from Friday looks positive, indicating a strong uptrend, and a “buy on the dips” strategy may be effective.

- The market has turned around, showing signs of life in the greenback, and we have even formed a double bottom near the 50% Fibonacci level, near the ¥127.50 level.

- As long as the market maintains this positive momentum, it is likely that most trend traders will follow the upward trend, which could lead to further gains.

It is important to pay attention to the 10-year yield in Japan, as it will have an impact on the yen’s performance. The higher the yield goes, the weaker the yen will be. So, traders should monitor this closely.

In conclusion, it seems that the US dollar is poised to continue its upward trajectory against the yen. The market is showing strong momentum, and as long as it maintains this trend, traders may find success with a “buy on the dips” strategy. Keep an eye on the 10-year yield in Japan for further insights into the market’s movements. As long as the Bank of Japan has that same monetary policy, there’s almost no way that the Japanese yen will do well as rates continue to go higher around the world. This is especially true against the US dollar as people look for safety.

[ad_2]