[ad_1]

Natural gas futures advanced in the middle of the week, with an intensification of work at a major export facility paired with the possibility of a cooler March to support the market.

Spot natural gas prices (CFDS ON NATURAL GAS) rose during their early trading on Thursday, achieving daily gains until the moment of writing this report, by 1.93%. It settled at $ 2.322 per million British thermal units, after rebounding yesterday from its lowest level since September 2020, to achieve a gain of 4.83%.

Natural gas futures advanced in the middle of the week, with an intensification of work at a major export facility paired with the possibility of a cooler March to support the market. March gas futures settled in the “NYMEX” on Wednesday at $ 2.174 per million British thermal units, up about 10.1. cents on the day, April futures rose 12.1 cents to $2,298.

Although it may be too late to tease a lot of renewable gas purchases in the near term, Freeport LNG’s long-awaited comeback is underway now that the facility has received federal approval to fully resume operations. The export terminal is set to reach Exporting 2 bcfd in the coming weeks, which at least could provide a floor for gas prices that briefly fell below $2,000 on Tuesday.

Analysts are sure to look for another lower-than-usual draw in the upcoming U.S. Energy Information Administration (EIA) inventory report, which will be published later Thursday. A Reuters poll of 14 analysts gave estimates ranging from 51 billion cubic feet to 100 Bcf averaged 68 Bcf, while the Wall Street Journal poll had the same range and averaged 69 Bcf.

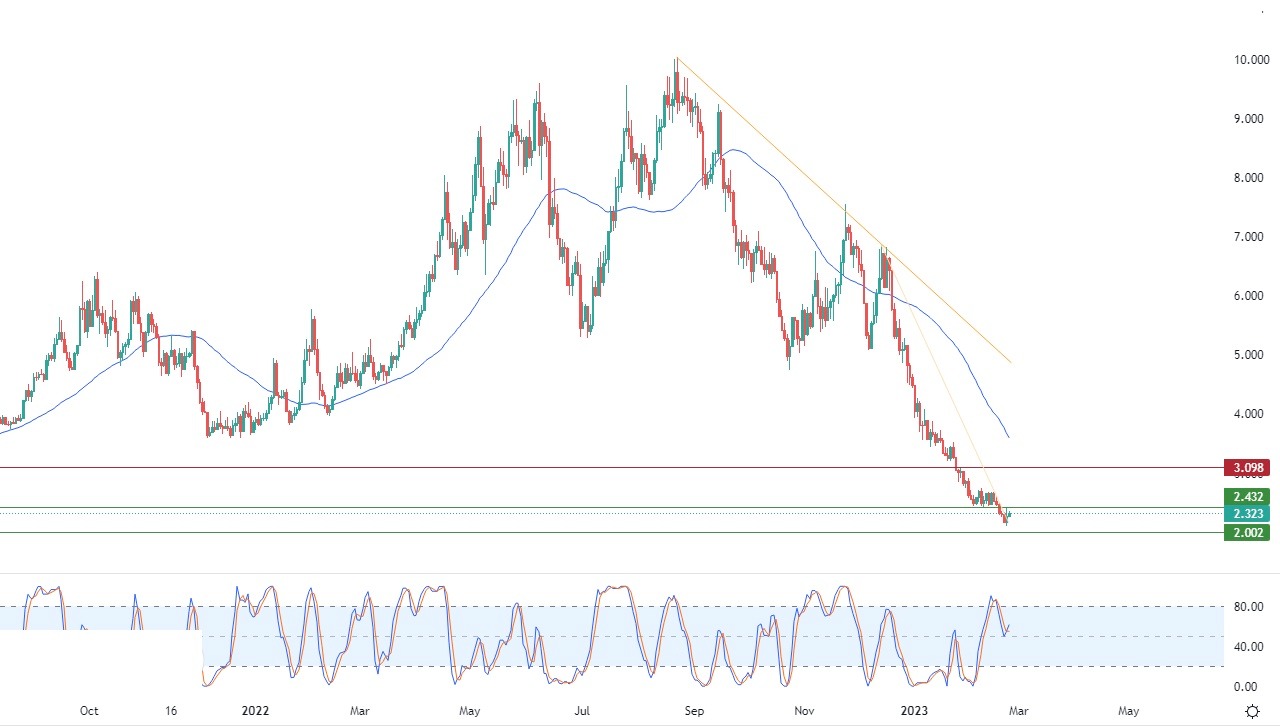

Technically, natural gas is trying, with its recent rise, to compensate for some of its previous losses, in light of the dominance of the main bearish trend in the medium and short term along the slope line. Negative pressure continued for its trading below the simple moving average for the previous 50-day period, in addition to that, we notice the presence of negative signals in indicators’ relative strength.

Therefore, our expectations suggest that natural gas will return to decline during its upcoming trading, especially if it stabilizes below 2.432, targeting the psychological support level at 2.00.

Ready to trade FX Natural Gas? We’ve shortlisted the best commodity trading brokers in the industry for you.

[ad_2]