[ad_1]

Traders should exercise caution and be prepared to adapt to changing market conditions.

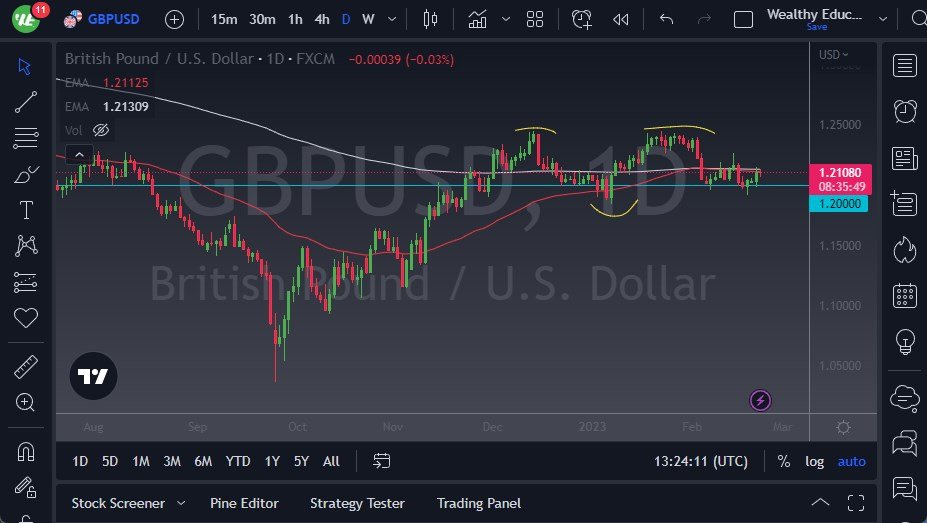

During Wednesday’s trading session, the British pound vs the US Dollar experienced a slight pullback, with significant volatility in the market. The 50-Day EMA has been providing resistance, and the 200-Day EMA has also been an area where we have seen selling pressure. With the recent pullback, we’re likely to see a lot of noise between the current level and the 1.20 level. This large, round, psychologically significant figure will be an essential support level, considering the strong support it previously provided.

However, if the 1.20 level breaks down, we could see a further decline to the 1.1850 level, which was a swing low and could serve as the bottom of the uptrend. If the market goes below this level, we could see a vacuum open up, which would lead to a potential decline to the 1.15 level. The shooting star from last week suggests that there’s significant resistance near the 1.2250 level. Breaking above that level could open up the possibility of a double top, which would extend resistance all the way to the 1.25 level. With the formation of a double top in that area, it’s clear that this level will be essential moving forward.

- If the market breaks above all of the resistance, it would continue the overall uptrend in the British pound.

- However, it’s worth noting that the price action over the last several weeks has been soft, indicating that a push in the market could quickly knock it over and lead to further declines.

- As such, traders should exercise caution and be prepared to adapt to changing market conditions.

In the forex market, it’s crucial to have a well-defined trading strategy and take a long-term perspective. Because of this, it’s likely that you need to look at the weekly charts as well. The forex market is dynamic and subject to change at any time, and it’s essential to exercise caution when trading by keeping your position size reasonable. While the British pound may face some resistance in the near term, it’s important to remember that the forex market is continually evolving, and traders should be prepared to adapt to changing market conditions. This is especially true during this market recently, due to the fact that we have seen so much in the way of noisy behavior, and of course a lot of greed and fear jumping back and forth into the psyche of traders.

Ready to trade our daily Forex forecast? We have made a UK forex brokers list for you to check!

[ad_2]