[ad_1]

The reality is that the market will probably continue to be very noisy, and therefore you need to be very cautious about your position size.

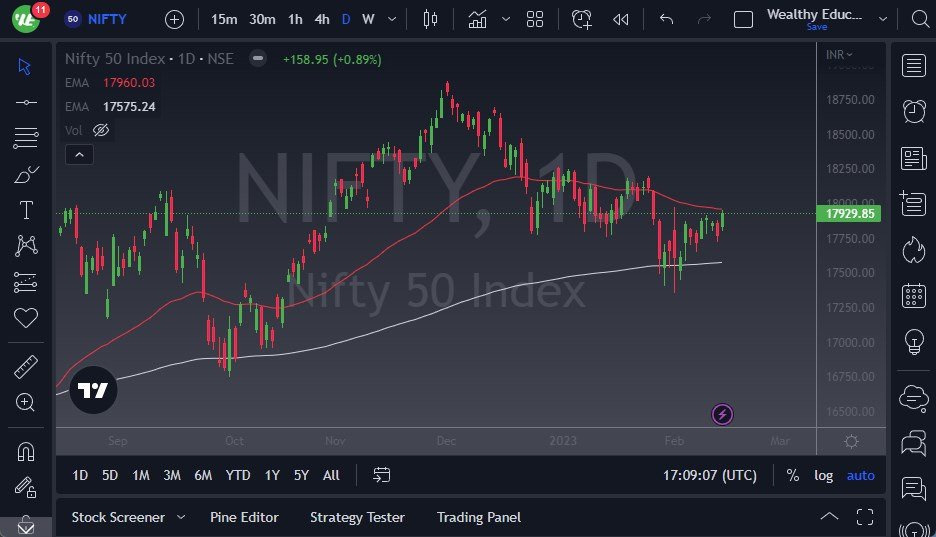

- The Nifty 50 has rallied a bit during the trading session on Tuesday, as we are now threatening the 50-Day EMA.

- As we approach this area, you also need to keep an eye on the 18,000 level, due to the fact that it is a large, round, psychologically significant figure, and an area where we’ve seen a lot of noisy behavior previously.

- At this point, if we can break above the 50-Day EMA, then it’s possible that we could go all the way to the 18,200 level.

Recent market movements have created excellent opportunities for gold traders.

Trade gold with a top-rated broker:

Noisy Behavior Ahead

On the other hand, if we were to turn around and fall, I think the 17,800 level is the first sign of support. Breaking down below there than opens up the possibility of a move down to the 200-Day EMA, which is closer to the 17,600 level. The reality is that the market will continue to see a lot of noisy behavior, and therefore it’s going to be difficult to hang onto any one position, but it is worth noting that India has outperformed in general. That being said, there were 3 large red candlesticks and got us down to the bottom and the 200-Day EMA, so I think that will continue to add a little bit of resistance above.

That being said, if we see a general selloff around the world, the Nifty 50 will more likely than not follow right along. After all, even though the Nifty 50 had outperformed for so long last year, the reality is that the global economy is starting to slow down, and people may be running away from some of the more emerging markets. After all, a lot of the noise that we are seen in the United States comes down to the zero day to expiration options being manipulated. The reality is that the market will probably continue to be very noisy, and therefore you need to be very cautious about your position size. Nonetheless, I do think that we have a good shot at seeing a little bit of a boost here, but whether or not we can continue to see the type of momentum that we saw last year still remains to be seen. Regardless, it does look a little bit more bullish than many of the other markets that I have been paying close attention to.

Ready to trade our daily technical analysis? Here’s a list of some of the best CFD brokers to check out.

[ad_2]