[ad_1]

- Inflation deepens the cost-of-living crisis in the euro area.

- This increases pressure on the European Central Bank to quickly start tightening its policy, as do the rest of the global central banks led by the US Federal Reserve.

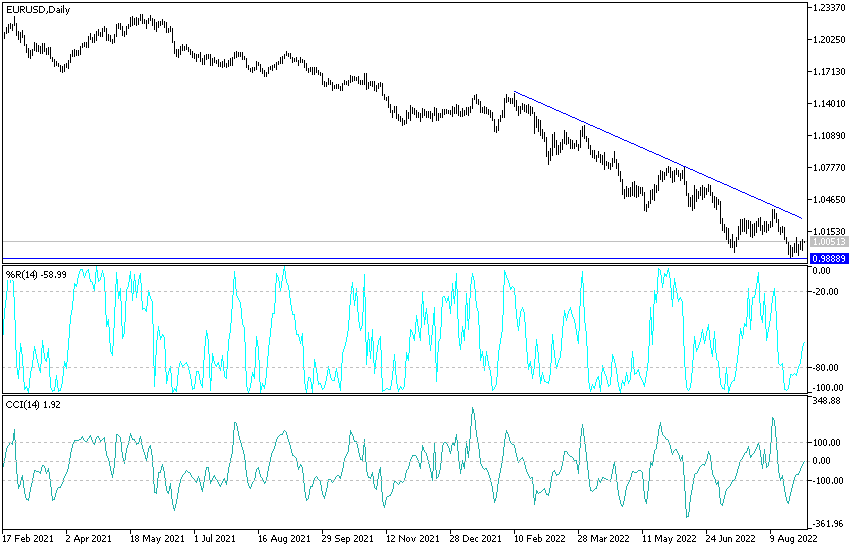

- The resistance is 1.0080, but the rebound may stop until the markets react to the announcement of the US jobs numbers.

- This week, the EUR/USD fell to the support level of 0.9900, the lowest in 20 years.

Results of economic data

Eurozone CPI inflation rose 9.1% year-on-year in August according to Eurostat, up from 8.9% in July and topping expectations for a 9.0% reading, deepening the cost-of-living crisis in the region. Although higher energy costs were the main reason for the rally, core inflation rose to 4.3% from 4.0%, well above expectations of 4.0%, adding to pressure on the European Central Bank to raise interest rates again in September.

Looking at the data, says economist Bert Cullen at ING Bank N.V. His main concern is the sudden increase in commodity inflation. “The increase from 4.5% to 5% was much larger than expected and raised concerns about the effects of the second round of the input cost shock lasting longer,” adds Colin, chief economist at ING.

It is the effects of the second round that are of particular concern to the ECB, and the data will solidify current market expectations for a 75 basis point hike in September. However, Cullen notes that the effects of the second round of wages and consumer demand are largely absent. The analyst added: “The latest negotiated wage growth data for the second quarter came in at 2.1%, which means there is no evidence of a wage and price vortex at this point.”

This may indicate that the ECB rate hike cycle will be short-lived.

Cullen added: “The economy is slowing down quickly – and may actually contract at this point – and the question is how much the ECB needs to apply the brakes, and the big question is how the ECB will respond next, if there are really economic indicators that the distress becomes more apparent. Inflation remains largely driven by supply-side factors.

Further price hikes are likely

A response note from TD Securities says, “Eurozone inflation is trending higher only from here, in part due to more upward pressure from higher natural gas prices, but also with the end of many government subsidies, such as the German public transport ticket. of 9 euros, the next two months.” For his part, says Salomon Fiedler, an economist at Berenberg Bank, Europe is facing an expensive winter. He also says, “Inflation in the euro area is likely to rise further and may exceed 10% in the fourth quarter. Natural gas prices are set to be the main driver of inflation rates for the remainder of 2022 and 2023.

Berenberg’s forecast assumes that standard wholesale prices will stabilize at less than 250 euros per megawatt-hour and decline after the cold season. High gas prices, which are passed on to consumers with delays, pose an upward risk to their expectations. Accordingly, Berenberg expects the ECB to raise interest rates by 50 basis points at the September 8 policy meeting, which sees a good opportunity for a move of 75 basis points. Economists at Handelsbanken say in the wake of the inflation release, along with ECB members’ data, that they now see an increased potential for a 75 basis point hike in September.

German CPI came in higher than expected at 7.9% y/y, vs. 7.5% previously and 7.8% expected. French CPI came in less than expected at 5.8% y/y, versus 6.1% previously and 6.1% expected. Italian CPI came in higher than expected at 8.4% y/y, versus 7.9% previously and 8.1% expected.

Forecast of the euro against the dollar today:

I expect that the bullish rebound attempts of the EUR/USD currency pair will remain limited and in a narrow range. It will strengthen only if the US jobs numbers come in less than expected. It will pave the way for a bullish weekly close in preparation for the next most important event next week, the monetary policy decisions of the European Central Bank. The nearest attempts to the current rebound are the resistance levels 1.0090, 1.0150 and 1.0260, respectively.

On the other hand, according to the performance on the daily chart, the euro-dollar currency pair returns towards the 0.9945 support, ending the current bullish expectations.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.

[ad_2]